Amazon SEO Keyword Research: Tools and Algorithm Insights for Higher Rankings

Parth’s nightmare started at 3 AM during peak festive season preparation.

His bestselling phone case - ranked #3 for "mobile cover" - had vanished from search results overnight. No warning. No notification. Just gone.

After three hours of panic and two support tickets, he discovered the culprit: his product title exceeded Amazon's new 200-character limit and repeated "mobile" four times. Amazon's January 2025 algorithm update had automatically suppressed his listing for policy violations.

Do you also feel sometimes you’re just experimenting with Amazon SEO? You're not alone.

Here's what's really happening: India's e-retail market hit $60 billion in 2024, but growth has slowed while seller competition intensified. Amazon offers over 168 million products to Indian customers, while there are 218,000 sellers actively selling on the platform.

This makes visibility more valuable - and harder to achieve - than ever.

This guide solves those problems with proven methods that work within Amazon's 2025 framework.

Ready to stop leaving money on the table? Let's master Amazon listing optimisation for businesses.

What is Amazon Keyword Research?

Think about the last time you searched for something on Amazon. Did you type "smartphone" or "best mobile phone under 20000 with good camera"?

Most customers use specific, purchase-ready phrases when they're ready to buy. That's exactly what Amazon keyword research captures: the precise terms customers use when they're pulling out their wallets.

But the catch is - Amazon's algorithm doesn't care if 50,000 people search for "phone case" monthly. It cares about which keywords lead to purchases.

Amazon SEO operates differently from Google because Amazon is a buying platform, not an information platform.

This fundamental difference changes everything about keyword strategy. Instead of targeting broad informational terms, smart sellers focus on commercial intent keywords that indicate purchase readiness.

Learn how to grow your e-commerce business on Amazon with our insights

How Amazon search works in 2025: What matters for keywords

Let's cut straight to what changed - because if you missed these updates, your listings might already be in trouble.

The January 2025 title rules that caught everyone off-guard

Amazon's new title requirements are hard limits that trigger automatic suppression:

- 200-character maximum for most categories. Not 199, not 201. Exactly 200 or fewer.

- No word repeated more than twice. If you use "mobile" three times in your title, you're risking suppression.

- Banned special characters include many symbols sellers previously used for emphasis.

Have you checked your titles against these requirements? If not, you could be one algorithm update away from disappearing from search results.

Backend search terms: The field everyone messes up

Your backend "Search Terms" field might look invisible to customers, but it's critical for ranking. Here's what most sellers don't realise:

- Amazon measures this field in bytes, not characters. Different characters consume different amounts of data. Exceeding the ~250-byte limit can prevent your entire listing from indexing properly.

- No repetition of terms already in your title, bullets, or description. Amazon's system automatically ignores duplicated content.

- No punctuation marks. Commas, periods, and other symbols waste precious space and can cause indexing failures.

Think about it: if Amazon can't properly index your listing, how can customers find it?

Why most sellers misunderstand Amazon's algorithm

Amazon ranks based on conversion probability.

This means a keyword that drives 1,000 monthly searches with 2% conversion will always lose to a keyword with 500 searches and 15% conversion. Amazon wants to show products that customers actually buy.

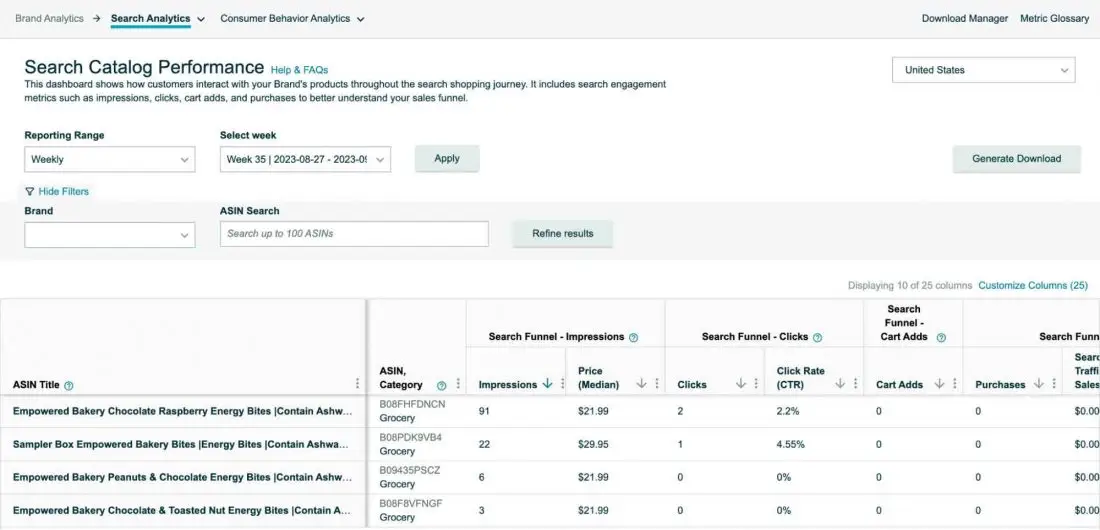

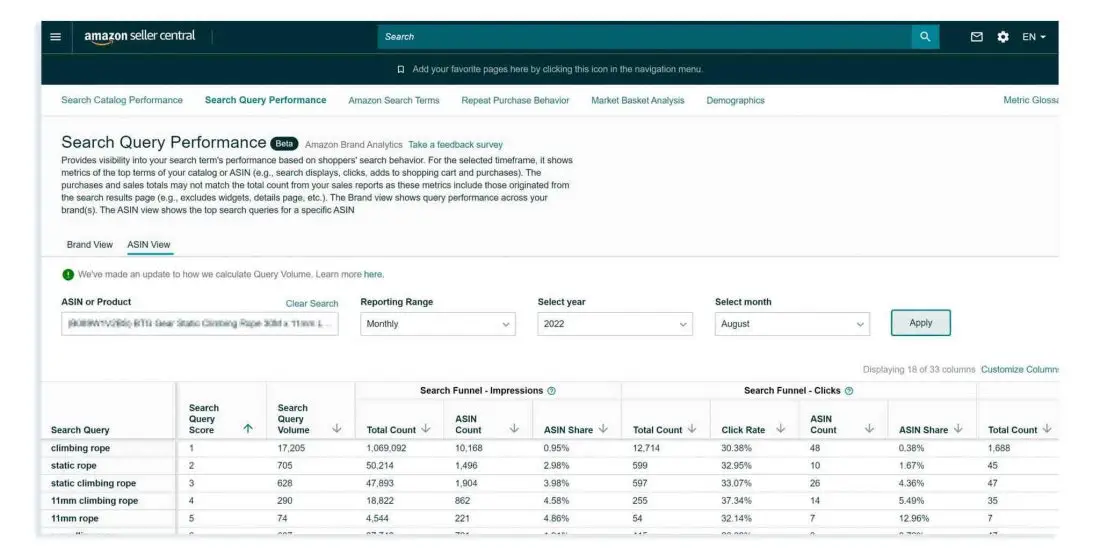

- Search Query Performance shows exactly how your products perform for different customer searches. Yet most sellers never check this data before making listing changes.

- Brand Analytics reveals market-wide search trends and competitor insights. It's free for Brand Registry sellers, but underutilised.

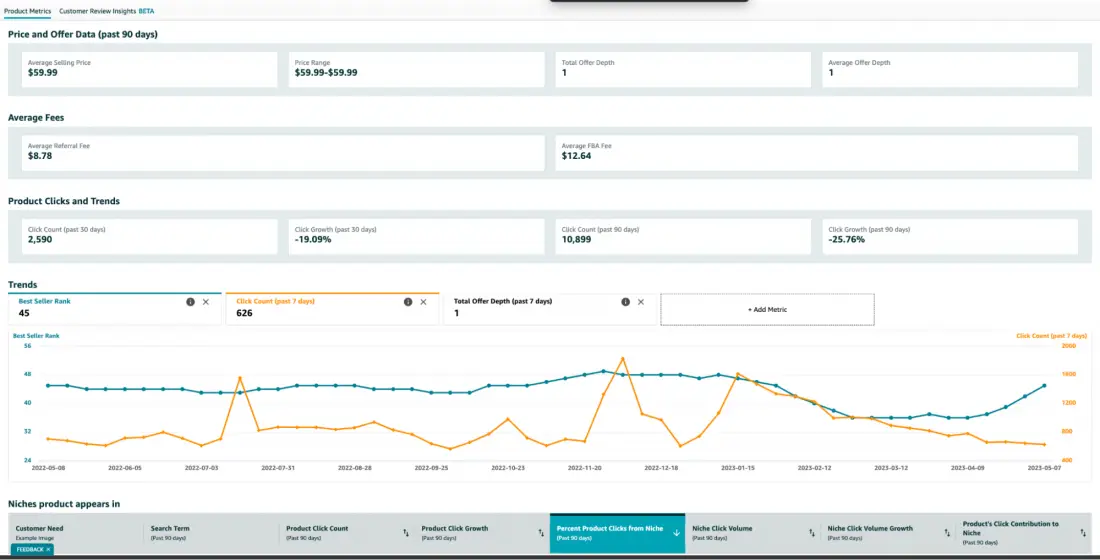

- Product Opportunity Explorer identifies rising search niches before they become saturated with competition.

Are you making optimisation decisions based on Amazon's actual data, or third-party estimates?

The festival season factor in India

Here's something international guides miss: India's e-commerce operates on festival cycles. Big Billion Days, Great Indian Festival, and regional celebrations create massive search spikes that can make or break your entire year.

Smart sellers use Search Query Performance to track seasonal patterns and adjust their keyword strategies before peak seasons, not during them.

When did you last check how your keywords perform during Diwali versus regular months?

If you’re new to Amazon, here’s how you can register your business in no time

4 proven Amazon keyword research methods that still win

The fundamentals work, but you need to execute them correctly within Amazon's 2025 framework. Here's how successful accounts with the best seller badge actually do keyword research.

1. Auto-suggest mining: Your customer's actual language

Amazon's search bar is a direct line to customer behaviour. Every suggestion reflects real searches from millions of Indian customers.

Start typing your main product name and watch what appears. These aren't random suggestions - they're ranked by frequency and purchasing behaviour.

Do this: Type your product category, then add each letter A-Z and capture suggestions. Repeat with spaces before each letter. This reveals both obvious terms and hidden long-tail opportunities.

But here's the advanced technique: look for question formats. When Amazon suggests "which mobile cover is best," it signals that customers are in comparison mode - a high-conversion mindset.

2. Reverse-ASIN competitor analysis: Steal legally

Your successful competitors have already spent time and money discovering which keywords convert. Why start from scratch?

Tools like SellerApp or Jungle Scout's reverse-ASIN feature reveal exactly which terms your competition ranks for and bids on.

Focus on relevancy over volume. A competitor ranking #5 for a highly relevant term presents a bigger opportunity than chasing #50 rankings for popular but irrelevant keywords.

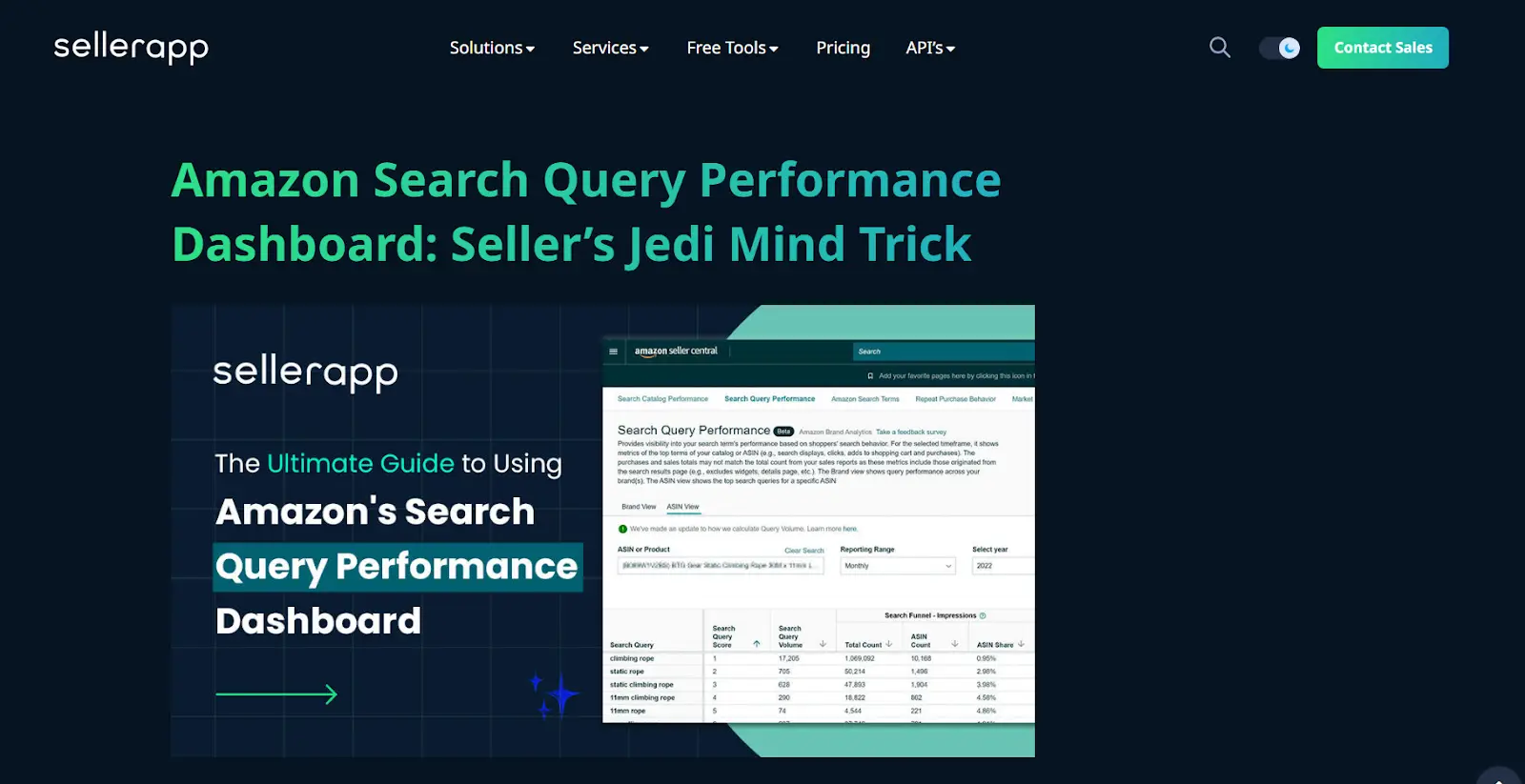

3. Amazon's native data: The truth source

Third-party tools provide estimates. Amazon provides facts.

Find out exactly which customer searches drive impressions, clicks, and purchases for your products. This data reveals which keywords work and which waste your time.

Look for queries where you get clicks but low purchase conversion. These represent optimisation opportunities - customers find you relevant enough to click, but something in your listing doesn't convince them to buy.

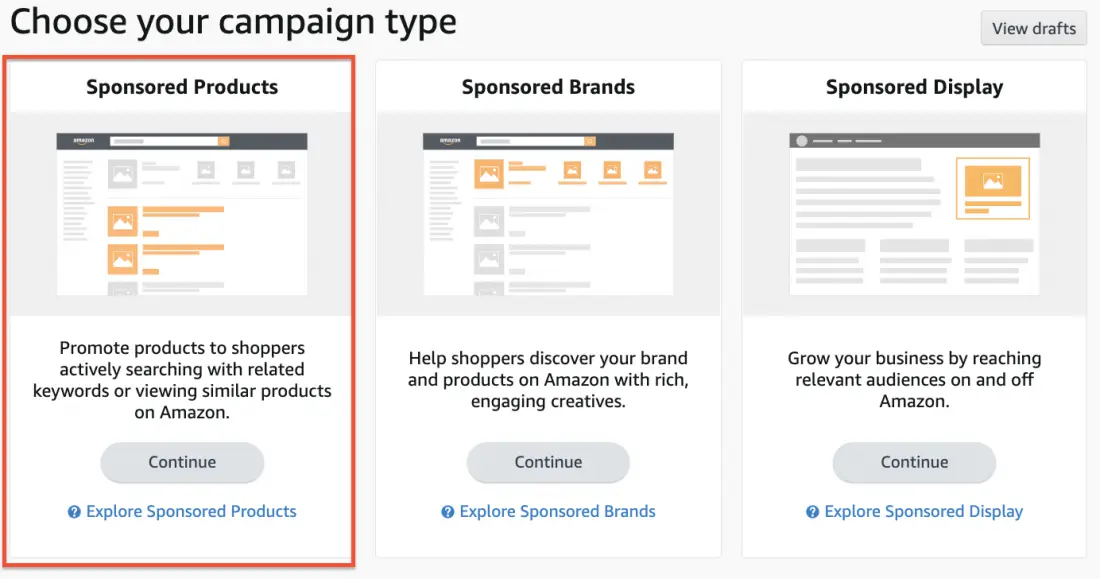

4. The PPC discovery loop

Sponsored Products campaigns serve double duty: driving immediate sales and uncovering new keyword opportunities.

Run phrase and broad match campaigns for your core keyword themes. The search term reports reveal the actual queries customers use to find and buy products like yours.

Looking to increase your Amazon sales? Check out our guide →

Step-by-step SOPs your team can follow for Amazon keyword research

Consistent execution beats perfect strategy poorly implemented. These standard operating procedures ensure your team maintains optimisation quality systematically.

SOP 1: Building your master keyword list (2 hours monthly)

- Step 1: Document your product's core attributes, materials, use cases, and problems it solves. This prevents keyword gaps.

- Step 2: Capture autocomplete variations directly from Amazon's search bar. Type your main product term, then add each letter A-Z noting suggestions.

- Step 3: Expand findings using your chosen tool (Helium 10 Magnet, Jungle Scout Keyword Scout, or SellerApp).

- Step 4: Tag each keyword by search intent: informational, comparison, or purchase-ready.

Deliverable: Tagged spreadsheet with 200-500 keywords organised by priority and intent.

SOP 2: Competitive gap analysis (1 hour weekly)

- Step 1: Identify 3-5 top-performing competitors based on sales rank and review velocity.

- Step 2: Run reverse-ASIN analysis using Cerebro, Keyword Scout, or manual research.

- Step 3: Filter for high-relevancy, medium-to-high volume keywords excluding branded terms.

- Step 4: Cross-reference with your current keyword set to identify gaps.

Deliverable: "Gap report" with target keywords mapped to placement strategy.

SOP 3: Amazon native data validation (30 minutes monthly)

- Step 1: Export Search Query Performance data for the previous 30 days.

- Step 2: Identify queries with clicks but low purchase conversion rates.

- Step 3: Cross-reference with Brand Analytics Search Terms for market context.

- Step 4: Prioritise terms where improved listing copy can increase conversion.

Deliverable: Top-20 priority keyword list with performance rationale.

SOP 4: Compliance-first keyword placement

- Title placement: Primary keyword + strongest modifier under 200 characters. Avoid repetition and banned characters.

- Bullet points: Secondary keywords in benefit-focused, readable copy. Natural integration without keyword stuffing.

- Backend search terms: Unique terms not appearing elsewhere, under 250 bytes, no punctuation.

Deliverable: Compliant listing copy with exact keyword placement documentation.

SOP 5: Festival season preparation (quarterly)

- Step 1: Review previous year's Search Query Performance during peak seasons (Diwali, Durga Puja, regional festivals).

- Step 2: Identify seasonal keyword variations and search spikes.

- Step 3: Prepare festival-specific PPC campaigns and listing updates.

- Step 4: Schedule implementation 4-6 weeks before peak season begins.

Deliverable: Festival keyword calendar with seasonal optimisation plan.

SOP 6: Vernacular keyword integration

- Step 1: Research Hindi and regional language synonyms for your main keywords.

- Step 2: Check Brand Analytics for vernacular search patterns in your category.

- Step 3: Integrate relevant vernacular terms in bullet points and backend fields.

- Step 4: Monitor performance through Search Query Performance.

Note: Focus on commonly used vernacular terms rather than direct translations.

7 recommended Amazon SEO tools for Indian sellers

The right tools accelerate research while providing competitive intelligence. Here's how successful Indian sellers choose and deploy these platforms.

1. Helium 10: The comprehensive choice

Helium 10's Magnet tool[1] expands seed keywords with search volume and trend data relevant to Indian markets. Cerebro provides reverse-ASIN analysis that reveals competitor strategies across multiple Amazon marketplaces.

The platform recently added AI-powered advertising features including automated budget management and multi-product campaign optimisation.

Best for: Sellers managing multiple products who need comprehensive research and ongoing monitoring capabilities.

Pricing consideration: Higher-tier plans unlock advanced features, but even basic plans provide valuable insights for most Indian sellers.

2. Jungle Scout: User-friendly with solid India data

Jungle Scout's Keyword Scout[2] provides clean, organised research with relevancy scores specifically calibrated for purchase intent rather than just search volume.

The Keyword Lists feature helps organise research findings into actionable optimisation workflows - crucial for managing large product catalogues.

Best for: New sellers who need intuitive interfaces and clear prioritisation guidance.

Pricing consideration: Plan-based search limits require careful budget planning for high-volume research.

3. SellerApp: Budget-friendly option designed for Indian sellers

SellerApp[3] provides essential keyword discovery and rank tracking with pricing accessible to smaller Indian sellers testing Amazon keyword research tools.

The platform includes specific features for Indian marketplace dynamics including festival season tracking and regional language considerations.

Best for: Cost-conscious sellers who need solid basics without premium pricing.

Limitation: Smaller feature ecosystem compared to international platforms.

4. DataDive: advanced clustering for serious sellers

DataDive specialises in sophisticated keyword clustering and competitive gap analysis. The "Rank Radar[4]" feature connects PPC performance data with organic ranking tracking.

This tool excels at transforming large keyword datasets into strategic launch plans through intelligent clustering.

Best for: Established sellers with complex catalogues who need advanced analytics.

Learning curve: Requires more technical knowledge but provides deeper insights.

Free alternatives: Amazon's own tools

Before investing in paid tools, maximise Amazon's free offerings:

5. Search Query Performance: Shows exact customer search behaviour for your products.

6. Brand Analytics: Provides market-wide search trends and competitor insights.

7. Product Opportunity Explorer: Identifies rising search niches and demand gaps.

These tools provide the most accurate data because they come directly from Amazon's systems.

Common Amazon SEO mistakes that kill rankings

Even experienced sellers make predictable errors that undermine their Amazon SEO efforts. Avoid these costly pitfalls:

1. Title policy violations

The January 2025 title rules aren't optional. Sellers continuing with 250-character titles or repeated keywords face automatic suppression.

Common violation: "Mobile Cover iPhone 14 Mobile Case Transparent Mobile Back Cover Protection"

Compliant version: "iPhone 14 Transparent Mobile Cover - Shockproof Back Case with Camera Protection"

2. Backend search terms disasters

Mistake: Copying title keywords into backend fields, exceeding byte limits, including punctuation.

Solution: Use unique, relevant terms not appearing elsewhere. Check byte count, not just character count.

3. Ignoring Amazon's own data

Making optimisation decisions based on tool estimates rather than Search Query Performance and Brand Analytics data misses actual customer behaviour.

Best practice: Always validate keyword opportunities with Amazon's native analytics before making significant changes.

4. A+ content misunderstanding

A+ Content supports conversion but doesn't carry the same algorithmic weight as titles and bullets for keyword ranking.

Focus: Use A+ Content for benefit communication and trust-building, not primary keyword placement.

5. PPC without impression share context

Harvesting keywords from PPC reports without considering Search Term Impression Share leads to poor bid decisions.

Solution: Use impression share data to identify where bid increases can profitably capture more qualified traffic.

The vernacular Amazon keyword research advantage Indian sellers miss

Most international Amazon SEO guides ignore a massive opportunity for Indian sellers: vernacular keyword integration.

Indian customers often search using English keywords mixed with Hindi terms or regional language concepts. "Mobile cover" might be searched as "mobile ka cover" or similar variations.

Brand Analytics reveals these patterns when you filter for India-specific search data.

Strategic vernacular placement

- Bullet points: Natural integration of Hindi or regional terms that customers actually use.

- Backend search terms: Include validated vernacular synonyms and alternative spellings.

- Avoid: Direct translations that customers don't actually search for.

Keep in mind that different regions celebrate different festivals with varying shopping patterns. Tamil customers search differently during Pongal than Bengali customers during Durga Puja.

COD and RTO considerations for Amazon keyword research

India's high Cash on Delivery (COD) usage and Return to Origin (RTO) rates create unique challenges that affect keyword strategy profitability.

- COD-specific keyword research: Customers choosing COD often search differently than prepaid customers. They might prioritise trust signals, local delivery, and return policies in their search terms.

- Managing RTO impact on PPC: High RTO rates (20-25% typical for COD orders) affect the profitability of different keywords. A keyword with high search volume but poor delivery completion rates destroys advertising ROI.

Your next steps to Amazon SEO success

Amazon SEO rewards sellers who combine compliance with customer-focused optimisation.

The sellers winning on Amazon India aren't using secret tactics. They're executing proven methods within Amazon's current framework consistently and systematically.

This is where GrowthJockey's marketplace building capabilities can be a significant boost.

Our AI-driven growth marketing platform - Intellsys gives you a competitive advantage. Instead of manually collecting data from multiple sources and wrestling with spreadsheets, successful sellers use integrated systems that automatically surface opportunities and track performance.

The result: faster optimisation cycles with measurable ROI improvements. While competitors manually piece together data, our clients make informed decisions quickly and scale their keyword strategies systematically.

Ready to move beyond guesswork? Our team combines strategic Amazon SEO expertise with automated intelligence that scales your optimisation efforts without scaling your workload.

FAQs on Amazon Keyword Research

How do I find keywords for my Amazon listing optimisation?

Start with Amazon's autocomplete suggestions and competitor reverse-ASIN analysis, then validate demand using Search Query Performance and Brand Analytics before placing terms strategically in compliant titles, bullets, and backend fields.

What is Amazon's current title character limit?

Amazon enforces a 200-character maximum for titles in most categories, with restrictions on special characters and no word repeated more than twice. Violations trigger automatic suppression.

How long should backend keywords be?

Backend Search Terms must stay under Amazon's 250-byte limit (not character limit) and exclude punctuation, repeated words from front-end fields, or irrelevant terms to ensure proper indexing.

What is Search Query Performance in Amazon SEO and how do I use it?

Search Query Performance shows which customer searches drive impressions, clicks, and purchases for your specific products. Use it to identify underperforming queries and optimise listing copy for better conversion.

How often should I update my Amazon keyword research strategy?

Monitor Search Query Performance monthly and adjust based on performance trends. Update listings quarterly or before festival seasons, avoiding frequent changes that disrupt established rankings.

Should I include Hindi keywords in my listings?

Include validated Hindi or regional terms that customers actually search for, based on Brand Analytics data rather than assumptions. Focus on commonly used variations, not direct translations.