How Do Startup Accelerators Work? Inside the Growth Engine

You’ll hear it everywhere, on founder calls, in investor meetings, even casually dropped on LinkedIn:

“We just wrapped our accelerator.”

“They’re a YC-backed company.”

“Demo day’s next week.”

But unless you've actually been through an accelerator, it all sounds a bit cryptic. Is it just mentorship? Free credits? Investor intros? Or is there an actual system behind the scenes?

Well, in practice, a startup accelerator is a 3-6 month, high-intensity accelerator program designed to help early-stage startups grow fast. In exchange for a small slice of equity (usually 5-10%), founders get hands-on mentorship, initial startup funding, and structured guidance to hit product-market fit, and do it quickly.

How's accelerator is different from a incubator? Think of it like this: if incubators are slow cookers for ideas still in early development, accelerators are pressure cookers for startups already in motion.

So if you're wondering, how do startup accelerators work, this breakdown will walk you through the full journey, from onboarding to Demo day, and what makes these programs such powerful launchpads for early-stage companies.

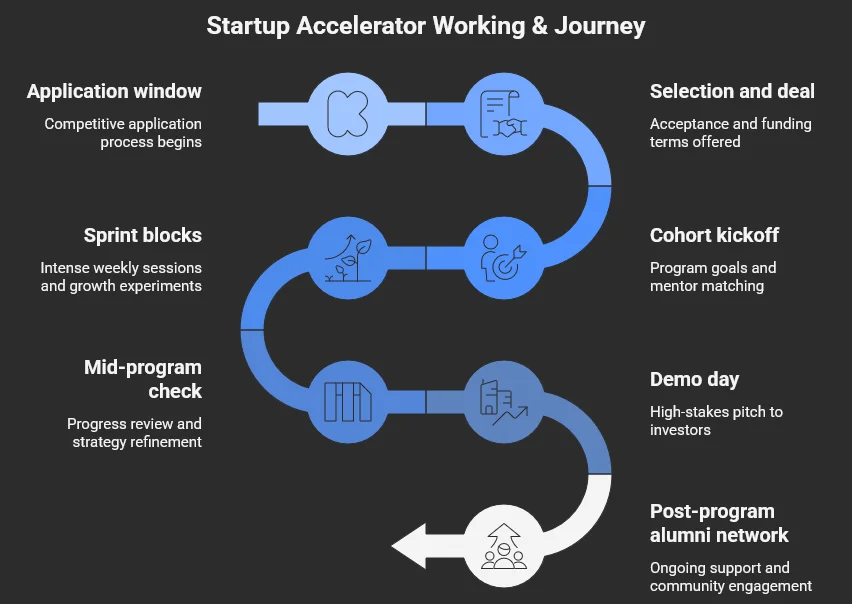

The end-to-end startup accelerator working process

If you’re thinking about joining a startup accelerator, understanding how the process actually works can help you make a more confident decision. These programs move quickly, pack in a lot, and ask for a real commitment of time, focus, and often equity. Knowing what to expect at each stage means you’re not walking in blind. You’ll have a clearer sense of whether this model fits your goals and how to get the most out of it if you do join.

Here’s a breakdown of the full startup accelerator process, from application to demo day, and everything in between:

Application window

Before you can experience how startup accelerators work in real life, you’ve got to get in, and that's no easy feat. Stanford's acceptance rate is higher than that of an accelerator, so that should give you a good idea of how competitive it is.

In fact, if you look at the data, the average acceptance rate is below 3%, meaning fewer than four startups out of every hundred get the nod. Even regional seed accelerator India programs are becoming increasingly selective, especially as startup ecosystems mature.

So if you want to stand out, accelerators tend to look for signals like these:

-

Traction that proves interest: Even a small pool of paying customers or active users shows that your solution solves a real problem.

-

A founder-market fit story: Accelerators want to see that you’re the right person to solve this, based on experience, insight, or obsession.

-

A clear, simple pitch: Your deck and video need to communicate the problem, product, and potential in under 3 minutes.

-

Team strength: Solo founders can get in, but a well-rounded team with tech and growth capabilities gives you an advantage.

-

Alignment with the program's focus: Some startup accelerator programs lean toward specific sectors or stages, so do your research and don’t apply blindly.

Getting through this first gate is a win in itself, and it sets the stage for what comes next.

Selection and deal

If you're in, you'll receive a term sheet, usually a SAFE (Simple Agreement for Future Equity) or a direct equity deal in exchange for 5-10% of your company.

Most startup accelerator programs offer startup funding in the range of $20,000 to $150,000. The money isn't massive, but the goal is to buy time to build, test, and grow with guidance.

At this stage, clarity matters: what will you use the capital for? Are you aligned with their growth philosophy? The deal terms are standardised, but this is when expectations are set on both sides.

Cohort kickoff

Kickoff week sets the tone. During this time, you’ll have to align on key goals for the program, like improving user retention, hitting a specific MRR target, or lining up investor meetings ahead of Demo day. These goals are often used to track your progress week over week.

You will also be matched with lead mentors who are experienced founders, operators, or investors, based on your industry, business model, or traction stage.

Top startup accelerator programs often keep the mentor-to-startup ratio small (as low as 3:1), so founders are not lost in a sea of generic advice.

This stage is also when you'll meet the other founders in your cohort. These moments go beyond just being mere icebreakers, with many founders leaning on each other for honest feedback, customer pilots, intros, or just sanity checks during tough weeks. That kind of startup support often outlasts the program itself.

Sprint blocks

Once the groundwork is laid, you’ll see how startup accelerators work day-to-day, which is in intense, focused sprints.

This entails participating in weekly office hours with program partners, tactical masterclasses from operators, and deep dives into customer acquisition, retention, and storytelling.

You're shipping fast, breaking what doesn't work, and doubling down on what does. Some programs also bring in VCs or successful alumni to run reverse pitch sessions or mock board meetings.

This is where much of the real value is created - the operational push, not just the theoretical talk. If you want to run these growth experiments without burning runway, you can plug Intellsys.ai- Growth marketing tool into your stack. It spins up A/B tests and channel experiments in hours, not weeks.

Mid-program check

Around halfway in, most accelerators run a formal check-in. Startups review progress against initial KPIs, troubleshoot what's lagging, and refine pitches ahead of Demo day.

Mentors and partners often challenge assumptions here, whether your ICP is clear, whether your CAC is scalable, or if your current strategy is investor-ready. This checkpoint often separates those who’ll attract interest from those who need a pivot.

Demo day

This is what everything builds up to. Demo day is typically a high-stakes 3-minute pitch delivered to a room full of investors, including angels, seed funds, and early-stage VCs. While the pitch itself is short, the preparation is anything but.

Founders spend weeks refining narrative, slide design, and delivery. A strong Demo day showing can lead to dozens of investor meetings in the weeks that follow.

But it’s not just about showmanship; investors look for founders who understand metrics, market, and momentum. So if you are able to deliver a great pitch, it can fast-track startup funding that might otherwise take months to secure.

To give you tangible proof, Wharton reported that startups that complete accelerator programs are 3.4% more likely to secure venture funding. On average, they also raise $1.8 million more in the first year after graduation compared to non-accelerator startups.

Post-program alumni network

If you are wondering, “What happens after Demo day? Am I on my own now?” Don’t worry, accelerators don’t just drop you at the finish line.

Once the curtains close on Demo day, many of the best accelerator programs for startups keep you in the game. That means ongoing startup support through alumni channels, periodic office hours, community events, and even warm intros to later-stage investors. This continued engagement is where the real payoff often happens.

In other words, the first cheque might jump-start your journey, but it’s this enduring startup accelerator process and community that power the push from seed to scale.

How do accelerator programs make money?

If you’ve ever wondered why an accelerator program would invest time, mentorship, and even startup funding into early-stage founders, the answer is simple: upside.

You already know that most programs take equity, usually in that 5-10% range. But what happens to that stake?

The real bet is that some of the startups they back will raise big rounds, get acquired, or go public. When that happens, the accelerator's equity converts into real returns. It’s high-risk, long-tail investing, but for programs like YC and Techstars, it’s paid off in billions.

Outside of equity, many accelerator programs also generate revenue through:

-

Corporate partnerships: Large companies often team up with accelerators for early access to innovation, product pilots, or even acqui-hire opportunities.

-

Government or university grants: Especially in seed accelerator India ecosystems, where public funding supports entrepreneurship.

-

Demo day sponsorships and event revenue: Investors, service providers, and ecosystem partners often pay to participate or gain visibility.

So while equity is the main engine, the smartest accelerator programs for startups build multiple income streams with each one reinforcing the other.

Is your startup a good fit for an accelerator?

Now that you’ve seen how startup accelerators work, it’s worth asking: are they right for where your startup is right now?

Accelerators are best suited for early-stage startups that are moving fast and ready to grow faster. A good benchmark? You’ve launched an MVP, validated demand, and are either pre-seed or raising your first institutional round.

You’re likely a good fit if:

-

You’ve got something live in the hands of users

-

Your team is working full-time, with the capacity to move fast

-

You’re coachable and open to structured feedback

-

You want to raise startup funding soon and need support navigating that path

On the flip side, deep-tech ideas still in the research phase or hardware-intensive builds might benefit more from incubators. In fact, many of the best incubators in India specialise in academic, biotech, or manufacturing-heavy projects where timelines and capital needs differ drastically, and that's also where partners like GrowthJockey come in.

As a flexible blend of startup accelerator and incubator, GrowthJockey supports founders across stages. So, whether you're validating an idea, chasing early traction, or scaling post-Demo day, we plug in where it matters most.

Pros vs. cons of joining a startup accelerator in India

Still confused about whether an accelerator is right for you? That's fair, startup accelerator programs can be intense, high-commitment, and not a perfect fit for every founder.

If you’re weighing the trade-offs, here's a clear breakdown to help you decide:

| Pros | Cons | |

|---|---|---|

| Accelerated learning curve - What might take 18 months to figure out on your own, you’ll cover in 3-6 months of guided sprints. | Equity dilution - Most programs take 5-10% in exchange for funding and support. | |

| Credibility with investors - Backing from a respected accelerator program signals traction and team quality. | Intense pace - The compressed format can lead to burnout if you're not prepared. | |

| Lifelong network - Access to mentors, peers, and alumni that often continues well after Demo day. | Mentor mismatch - Not every startup gets paired with the perfect advisor. |

If you’re not ready to give up equity or want to maintain slower, bootstrapped control, consider other options like revenue-based financing, government grants, or one of the many best incubators in India.

But if you're looking to fast-track growth, sharpen your pitch, and access structured startup support, a startup accelerator might be exactly what you need.

How to choose the right accelerator for your startup

There are hundreds of startup accelerator programs out there, but not all of them are built to serve your business. Some have deep sector expertise. Others offer great funding but fall short on mentorship. The trick is figuring out which one can give you results for your stage, sector, and team.

Here's what's worth paying close attention to:

-

Sector focus and mentor quality: Look for programs that have real traction in your industry, like fintech, climate, or SaaS, and can match you with mentors who’ve built in that space. A stacked mentor list means nothing if no one’s hands-on.

-

Alumni outcomes: A strong alumni track record says a lot. Check if past startups went on to raise follow-on funding, exit, or even just survive tough markets; that’s a strong signal the accelerator knows how to support real growth.

-

Deal terms: Review the offer closely. What’s the cheque size? How much equity do they take? Do they offer pro-rata rights in future rounds? Across 400+ programs worldwide, the median deal is $38k for 7% equity, a useful yardstick when you’re comparing term sheets.

-

Remote vs. in-person, and culture fit: Think about logistics. Are you expected to relocate? Is there visa support? Just as important, does the program feel like a place where your startup will thrive? Culture and founder-community alignment matter more than most people realise.

At the end of the day, picking the right accelerator program comes down to fit. Look at who they've helped, how they work, and whether their approach fits your goals. Take the time to vet them like they're vetting you.

Ready to find an accelerator that matches your next stage?

Now that you know how startup accelerators work, you can stop guessing and start evaluating. These programs can open doors, but only if they match where you are and where you’re headed.

Look for an accelerator program that doesn't just fund you, but pushes your thinking, challenges your strategy, and keeps you focused on what really drives growth. The right one will speed you up, not send you sideways.

If you’ve already validated your idea and you're ready to scale faster, GrowthJockey can help you do exactly that. You'll get data-backed go-to-market strategies, agile experimentation powered by Intellsys.ai, and real strategic support.

You’ve figured out what works. Now it’s about growing what matters.

FAQs on how do startup accelerators work

Are startup accelerators worth it?

Yes, startup accelerators can be incredibly valuable if you're at the right stage. They offer structured mentorship, startup funding, and fast-track access to investors and peers. The key is picking an accelerator program that aligns with your goals, product maturity, and growth needs.

How do I pitch to an accelerator?

Your accelerator pitch should clearly explain the problem you're solving, your traction so far, and why your team is the one to bet on. Most startup accelerator programs look for clarity, focus, and early signs of product-market fit. Keep it sharp, data-backed, and under 3 minutes if it's a video submission.

What are the disadvantages of accelerators in business?

The main downside of joining a startup accelerator is equity dilution; you give up a percentage in exchange for support. Some founders also find the pace overwhelming or struggle with mentor mismatches. It’s important to evaluate the program's structure and whether its startup support matches your working style.

What do you mean by bootstrapping?

Bootstrapping means building your startup without external funding so, using your own savings or early revenue to grow. It gives you full control but often slows down your timeline compared to accelerator programs. Many founders bootstrap until they're ready to scale, then join a seed accelerator for added leverage.