How is Hyperlocal Delivery Transforming Retail in 2025

The way people shop and consume is changing at lightning speed. Gone are the days when waiting two or three days for an e-commerce order was acceptable. Today, customers expect groceries, medicines, and even electronic accessories to arrive in minutes.

This dramatic shift is being powered by hyperlocal delivery an on-demand fulfillment model that connects nearby stores, dark stores, or micro-warehouses with customers in small, defined geographic areas. Orders are routed digitally, couriers are dispatched instantly, and delivery happens in less than an hour - often in 10–30 minutes.

According to Fortune Business Insights, the global hyperlocal services market was valued at USD 3.37 trillion in 2023[1] and is expanding rapidly. Asia-Pacific, driven by India and China, leads adoption thanks to smartphone penetration, rising disposable income, and the explosive growth of digital payments.

In India, quick-commerce grocery alone is projected to reach USD 5.5 billion by 2025[2], growing at 10–15% annually. For startups, retailers, and logistics professionals, hyperlocal delivery represents both a challenge and a massive opportunity.

What is Hyperlocal Delivery?

At its core, hyperlocal delivery is an ultra-fast, tech-driven logistics model where goods or services are delivered from nearby vendors to customers within a small radius usually 5–15 kilometers.

Customers order through an app or website. The system identifies a local merchant who has the item in stock, and a delivery partner is dispatched to pick it up. Because the store and courier are nearby, fulfillment happens in minutes rather than days.

Hyperlocal delivery is especially relevant for time-sensitive and frequently purchased goods like groceries, food, and medicines. It blends the convenience of online shopping with the immediacy of local retail.

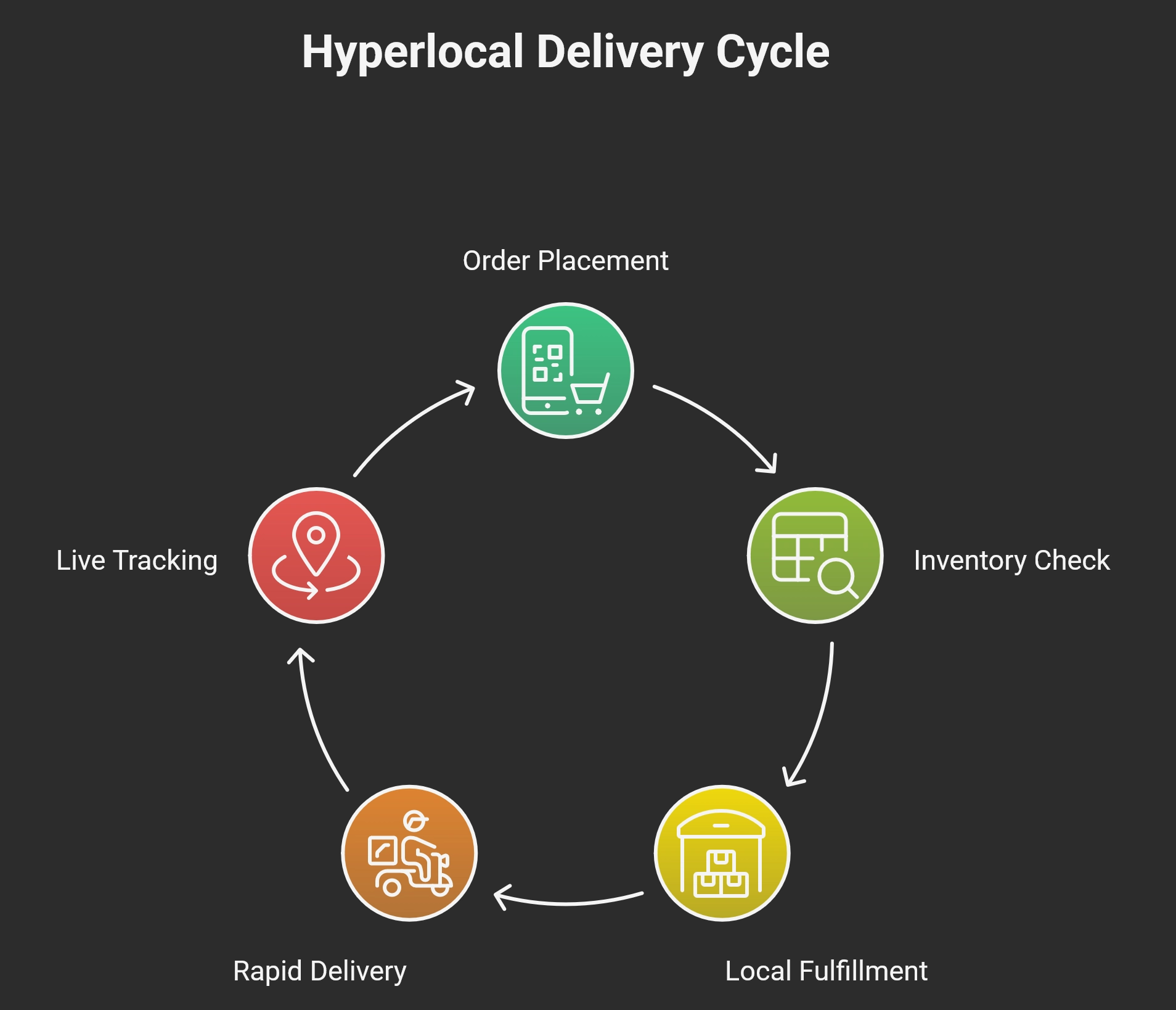

How Hyperlocal Delivery Works

Hyperlocal delivery operates through a tightly integrated digital process that ensures speed and accuracy.

1. Order Placement

Customers place orders via mobile apps or websites. The platform runs real-time inventory checks with local stores to confirm availability.

2. Local Fulfillment

Partner stores, dark stores, or micro-warehouses pack the items immediately. Since they are located close to the customer, fulfillment is almost instant.

3. Rapid Delivery

Delivery management software auto-assigns a courier. Route optimization ensures the fastest path, while live tracking keeps customers updated.

This loop - from order to doorstep - is powered by advanced algorithms, GPS, and automated inventory syncing. The result is same-hour or even sub-20-minute delivery.

Key Characteristics of Hyperlocal Delivery

-

Localized Scope: Operations restricted to small zones, often no larger than a few kilometers.

-

Ultra-Fast Fulfillment: Promises of 10–30 minute deliveries are now common in metro cities.

-

Proximity Advantage: Leveraging closeness cuts travel time, costs, and emissions.

-

Technology-Driven: Every step - inventory, courier assignment, route optimization is digital.

-

Community-Centric: Supports neighborhood businesses and builds trust with local consumers.

| Industry | Use Case | Example Platforms |

|---|---|---|

| Food Delivery | Hot meals delivered instantly | Swiggy, Zomato |

| Groceries | Fresh produce, daily staples, dairy | Blinkit, Zepto, BB Now |

| Pharmaceuticals | Urgent medicines and healthcare items | Apollo, NetMeds, 1mg |

| Retail/E-commerce | Same-day electronics, apparel, pet care | Flipkart Quick, Amazon Fresh |

| Other Services | Courier, laundry, repair, concierge | Dunzo, Porter, Rapido |

Hyperlocal thrives where immediacy matters most. For perishable goods and urgent needs, it bridges the gap between offline shopping and traditional e-commerce.

Benefits of Hyperlocal Delivery

For Customers

Hyperlocal delivery provides unmatched convenience and speed. Imagine realizing you’re out of sugar while cooking within 15 minutes, it’s at your doorstep.

Real-time tracking builds trust, while subscription models like Swiggy One or Blinkit Prime keep costs low for frequent users. This ease of access encourages repeat usage, forming long-term habits.

For Businesses and Startups

Startups use hyperlocal delivery to scale without massive infrastructure. Instead of large regional warehouses, they operate micro-warehouses within city neighborhoods.

For instance, Swiggy Instamart leveraged dark stores to expand rapidly while keeping fulfillment fast. This approach cuts storage costs and allows businesses to adapt to local demand trends.

For SMEs and Local Retailers

Neighborhood shops benefit from what’s called the “digital discovery effect”. By listing on hyperlocal apps, a kirana store or local bakery gains online visibility and can serve hundreds of new customers beyond walk-ins.

This levels the playing field against e-commerce giants, giving SMEs access to the same instant delivery infrastructure.

For Local Economies and Sustainability

Hyperlocal delivery keeps money circulating locally by supporting small vendors, delivery partners, and service providers.

Environmentally, it is greener than long-haul shipping. Shorter routes mean lower fuel usage and fewer emissions, aligning with urban sustainability goals.

Technology & Platforms Driving Hyperlocal Delivery

Hyperlocal delivery depends on an ecosystem of integrated technologies.

Order and Inventory Management

Real-time syncing ensures customers only see available items. Orders are auto-routed to the nearest vendor or dark store for immediate processing.

Routing and Optimization

AI-driven algorithms predict the fastest routes by analyzing live traffic and road conditions. Some platforms use batching - assigning multiple nearby orders to one courier - to improve efficiency.

Real-Time Tracking

Customers expect visibility into their delivery. Live tracking reduces failed attempts and enhances satisfaction. Retailers use the same dashboards for monitoring courier performance.

Data and AI

AI forecasts demand spikes and optimizes stock placement. For example, platforms may detect that bananas sell out by 6 PM in a particular neighborhood and pre-stock accordingly.

Hyperlocal Delivery Software

Startups and SMEs can adopt ready-made solutions like Locus, WareIQ, or JungleWorks Yelo to launch quickly. Large enterprises often build proprietary systems integrated with ERP and CRM platforms.

Challenges in the Hyperlocal Ecosystem

Cut-Throat Competition

Blinkit, Zepto, Instamart, and BB Now are battling for market share. Deep discounts and free deliveries inflate customer acquisition costs, forcing smaller players to exit.

Profitability Pressure

Margins are razor-thin[3]. A ₹50 delivery fee rarely covers courier pay, fuel, and software costs. Success depends on high order density - completing multiple deliveries per courier per hour.

Dunzo’s struggles in scaling its Daily service illustrate how difficult it is to sustain profitability at speed.

Inventory Management

Stockouts frustrate customers and damage brand trust. Dark stores reduce this risk but increase operational costs. Balancing availability with profitability is a constant battle.

Operational Complexity

Managing thousands of couriers in real time requires robust platforms. Idle drivers or peak-hour surges create inefficiencies. Worker churn adds to the challenge.

Regulation and Infrastructure

Traffic congestion, parking restrictions, and inconsistent addresses delay deliveries. Drone pilots remain limited due to regulatory hurdles from the DGCA.

Hyperlocal Delivery in India: Market Trends

India has become a global leader in hyperlocal adoption. The model surged during COVID-19, when customers turned to apps for essentials. Today, it has evolved into a default behavior for urban consumers.

-

The quick-commerce is expected to reach USD 5.5B by 2025.

-

Zepto became a unicorn in under two years, fueled by investor enthusiasm.

-

Zomato’s acquisition of Blinkit consolidated leadership in the space.

Metro cities are saturated, so companies are expanding into Tier-2 and Tier-3 towns. The challenge lies in lower order frequency and weaker infrastructure, but the opportunity is massive.

Consumer behavior is also shifting. Instead of bulk weekly shopping, many now place multiple small orders each week, valuing speed over volume.

Leading Hyperlocal Delivery Companies in India

| Company | Delivery Time Promise | Product Focus | Notable Features |

|---|---|---|---|

| Swiggy Instamart | 10–15 minutes | Groceries & essentials | Uses dark stores + existing delivery fleet |

| Zomato Market | Under 20 minutes | Grocery & essentials | Local dark store network |

| Blinkit | 10–20 minutes | Groceries | Hundreds of micro-warehouses |

| BigBasket Now | ~60 minutes | Groceries & essentials | Mix of warehouses and dark stores |

| Zepto | 10 minutes | Groceries & essentials | Rapid scale in metros |

| Flipkart Quick | 10–15 minutes | Multi-category | AI-driven stocking and city hubs |

| Dunzo | ~19 minutes on average | Variety (groceries, meds, courier) | Subscription plans; Reliance-backed |

| Amazon Fresh | 2–4 hours | Grocery & essentials | Large product range coverage |

Hyperlocal Delivery Charges

The pricing of hyperlocal delivery in India is designed to balance affordability for customers with sustainability for platforms. Most services charge a flat fee ranging from ₹20 to ₹50 for small orders, making it convenient for quick top-ups. To encourage larger baskets, many platforms waive charges on orders above a certain threshold, typically ₹200–₹300.

Subscription models such as Swiggy One, Zepto Pass, and Blinkit Prime have become popular, offering unlimited or discounted deliveries for a monthly fee. In high-demand situations - during peak hours, festivals, or heavy rain - surge pricing is often applied. Ultimately, profitability does not come from delivery fees alone but from achieving high order density, efficient batching, and upselling to customers.

Future of Hyperlocal Delivery

The future of hyperlocal delivery in India is both exciting and complex. The much-debated 10-minute commerce model continues to capture attention, with companies promising ultra-fast essentials while simultaneously exploring hybrid systems that combine instant drops with scheduled deliveries. Artificial intelligence will play a larger role in shaping the ecosystem, from predictive demand forecasting to smart inventory staging that reduces delays.

Sustainability will also define the next decade, as players increasingly switch to electric bikes, bicycles, and green supply chain practices to meet carbon-neutral goals. Beyond metros, the next growth wave lies in Tier-2 and Tier-3 cities, though these regions pose infrastructure challenges and lower order density. In the long run, automation through drones and delivery robots could reshape cost structures and coverage, though widespread adoption depends on regulatory support. Hyperlocal delivery is set to evolve from a metro-centric trend into a nationwide commerce backbone.

GrowthJockey’s Role in the Hyperlocal Era

GrowthJockey specializes in venture architecture, building bold new ventures from ideation to scaling using proprietary AI infrastructure (intellsys.ai) that accelerates data-driven sales and marketing strategies. Unlike traditional consultancies or marketing agencies, GrowthJockey combines entrepreneurial domain expertise with technology innovation to architect sustainable business models.

In the hyperlocal delivery space, GrowthJockey’s approach enables enterprises to:

- Identify strategic opportunities for hyperlocal solutions aligned to market needs.

- Design user-centric platforms integrating advanced logistics, AI, and customer experience.

- Build and scale ventures rapidly by leveraging agile, data-driven methods.

- Support go-to-market execution with cutting-edge digital growth hacking and partnerships.

By merging design, build, and growth functions seamlessly, GrowthJockey helps businesses harness hyperlocal delivery’s full potential and achieve competitive advantage in fast-evolving markets.

FAQs On HyperLocal Delivery

What is hyperlocal delivery?

Delivery from nearby stores within a small radius, usually under an hour.

What is hyperlocal delivery in JioMart?

JioMart delivers groceries in 30–60 minutes in select Indian cities.

How much time does hyperlocal delivery take?

10–30 minutes on average; 2–4 hours for some categories.

Which companies offer hyperlocal delivery in India?

Blinkit, Zepto, Swiggy Instamart, Zomato, BB Now, Flipkart Minutes, Dunzo, Amazon Fresh.