8 Market Analysis Tools That Businesses Need for Growth in 2025

Your competitor just doubled their traffic. You found out three months later from a LinkedIn post. Has this ever happened with you?

That's what happens when businesses run on quarterly reports while markets move in real-time. The gap between what you know and what's actually happening becomes a revenue killer. The best market analysis tools close that gap, but picking the right ones feels like choosing a needle from a stack of needles.

What you really need is the right combination that answers your specific questions. Whether that's tracking digital market intelligence, mining competitive data, or building comprehensive market intelligence reports, this guide shows you exactly which platforms deliver.

What is a Market Analysis Tool?

These platforms do what spreadsheets can't: track, analyse, and predict market movements before they hit your bottom line.

Modern market analysis tools go beyond basic metrics by pulling data from websites, apps, social platforms, search engines, and even investment databases.

Then these market tools turn this mess into answers you can actually use. Who's gaining market share? Which keywords drive conversions? Where are customers frustrated?

The best competitive intelligence tools work like having a spy network, analyst team, and fortune teller rolled into one platform. Except it's legal, accurate, and updates regularly.

Top 8 market intelligence tools for all your needs

Each tool dominates a specific intelligence need. Check our curated list of the top competitor marketing analysis tools:

1. Similarweb

Best for: Digital market share, traffic mix, and competitor benchmarking.

Why it matters: Market Explorer and Traffic Analytics help you size categories, see who wins visits, and spot shifts in acquisition strategies. Similarweb[1] has leaned into faster, more actionable market views and AI-assisted analysis across 2024–25 updates.

Stand-out features:

- Market Explorer maps leaders and growth trends with fresh data updated within 28 days.

- The platform tracked 1.1 billion AI-referral visits in 2024 (up 357% year-on-year), helping you understand how ChatGPT and similar platforms reshape traffic patterns.

- Their SimilarAsk feature lets you query data using natural language.

2. Semrush .Trends (Market Explorer)

Best for: Competitive web analysis with a clear quadrant view of a market.

Why it matters: Market Explorer shows players by growth and share so you can see leaders, game changers, and niche players. Semrush is useful for entry analysis and for tracking how strategies shift over time.

Stand-out features:

Growth Quadrant visual gives you instant market positioning.

- Create custom competitor lists up to 100 domains or let the platform find them automatically.

- The tool analyses 110 business categories with seasonal trend views that tie into wider Semrush research.

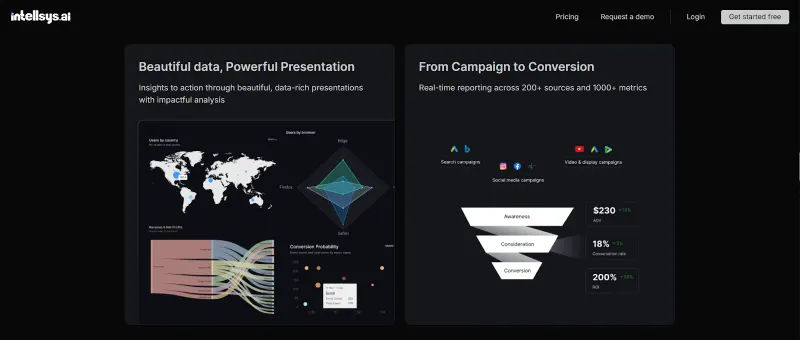

3. Intellsys by GrowthJockey

Best for: Turning market and marketing data into weekly decisions that move revenue.

Why it matters: Most teams drown in exports. Intellsys - an AI-driven tool connects data sources, automates reporting, and layers advanced analytics like marketing mix modelling, attribution, and AI-driven recommendations.

Public materials highlight automated insights, drag-and-drop custom reports, and real-time decisioning, all while cutting marketing costs by up to 38%.

Stand-out features: GrowthJockey positions this as an AI copilot for growth marketing.

- It connects 200+ data sources and tracks 1000+ metrics in real-time.

- The platform promises to save 15-20 hours weekly whilst delivering 25-40% ROI improvements.

- Unlike pure market tools, it bridges analysis with execution.

4. Brandwatch Consumer Intelligence

Best for: Consumer and category intelligence from public conversations at scale.

Why it matters: Brandwatch[2] ingests and analyses large volumes of social and web data. You can segment topics, track sentiment, and tie content or creator trends to shifts in demand.

Stand-out features:

- Their AI assistant Iris summarises insights from 1.7 trillion historical conversations dating back to 2010.

- Image analysis detects objects and logos automatically.

- Auto-segmentation with machine learning classifiers helps teams move from raw mentions to decisions faster.

5. Sensor Tower

Best for: App economy, downloads, revenue, advertising intel, and category sizing on mobile.

Why it matters: If mobile drives your market, you need clean views of installs, spend, and creatives. In 2024 Sensor Tower acquired data.ai (formerly App Annie), consolidating two of the biggest mobile intelligence providers. That means broader coverage.

Stand-out features:

- Their State of Mobile 2025 report shows consumer spend hit ₹12.5 lakh crores globally.

- Use it to size app categories, benchmark rivals, and plan creative tests.

6. PitchBook

Best for: Private markets, deal flow, valuations, and investor activity.

Why it matters: For market sizing and category health, capital flows and exits are strong signals. PitchBook[3] tracks venture, PE, M&A, and now deeper private credit activity with expanded coverage.

Stand-out features:

- Broad deal, company, and fund datasets, with forward-looking outlooks that frame the year's themes across sectors.

- Analysts' 2025 outlooks help you set context for strategy decks. The platform now covers private credit markets more comprehensively.

7. Statista

Best for: Quick top-down market sizing and presentation-ready stats.

Why it matters: Statista[4]'s Market Insights and Consumer Insights provide curated data for 190+ countries. In 2025 you can pull fresh global survey data when you need fast context for a market. Always click through to the cited primary source.

Stand-out features:

- Updated Consumer Insights surveys and dashboards help you benchmark demand and behaviour without commissioning research from scratch.

- The platform aggregates data from 1,000+ markets across 190+ countries.

8. Qualtrics (Market Research & XM)

Best for: Primary research at enterprise scale with AI-assisted design and analysis.

Why it matters: Secondary data isn't enough for positioning or pricing. Qualtrics[5] gives you survey design, sampling, and analysis in one place, with AI to speed questionnaire building and insight generation.

Stand-out features:

- X4 2025 showcases new Qualtrics AI capabilities across the XM Platform, focused on faster insight and better automation from study design to reporting.

- The platform powers over 1 billion surveys yearly.

How to pick the right mix of market analysis tools

Building your market analysis stack is more than having the most tools. It's about covering your blind spots.

- Start with your market's main channel. If discovery is web-led, use Similarweb or Semrush for share and trends. If mobile drives the category, add Sensor Tower.

- Add the voice of the customer. Use Brandwatch for conversation themes. Run targeted studies in Qualtrics when you need proof for positioning or pricing.

- Get investor context when it matters. Use PitchBook to understand funding heat, valuations, and likely buyer sentiment in your space.

- Keep a stats layer for slides. Pull Statista charts for quick top-down context, then validate at the source.

- Close the loop. Pipe outputs into Intellsys, an AI co-pilot, so leaders see one plan, one set of numbers, and weekly recommendations tied to MMM or multi-touch attribution, not hunches.

Build the best market analysis tools stack for your business

Here's what separates data hoarders from market leaders: execution speed. You can track every competitor move, map every trend, analyse every conversation. But if it takes weeks to act on insights, you've already lost.

That's why smart teams are moving beyond standalone market analysis tools to integrated intelligence systems. Intellsys by GrowthJockey exemplifies this shift.

Instead of juggling five platforms and drowning in CSV exports, you get unified intelligence that triggers actual decisions.

Pick your tools, yes. But more importantly, pick how you'll act on what they tell you.

FAQs on Competitive Intelligence Tools

Which tool is used for market analysis?

Popular market analysis tools include Similarweb for web traffic intelligence, Sensor Tower for mobile app data, Brandwatch for social listening, and Semrush for SEO and digital marketing analysis. Combine all your data in one place with Intellsys. Most businesses combine 2-3 platforms for comprehensive competitive intelligence.

What are the 5 C's of marketing analysis?

The 5 C's framework covers Company (internal capabilities), Customers (needs and behaviours), Competitors (strengths and strategies), Collaborators (partners and suppliers), and Context (market conditions). Modern business intelligence tools for marketing help analyse each C with real-time data.

Which AI tool is best for market analysis?

For AI-powered market analysis, Brandwatch's Iris assistant processes billions of conversations, Similarweb's SimilarAsk enables natural language queries, and Intellsys by GrowthJockey serves as an AI copilot connecting 200+ data sources. Each excels in different areas of competitor marketing analysis tools.

Can SWOT be used for market analysis?

Yes, SWOT analysis works for markets, not just companies. Market tools provide the data to identify market-wide Strengths (growth areas), Weaknesses (gaps), Opportunities (unmet needs), and Threats (disruptions). Combine SWOT with quantitative data from competitive intelligence tools for deeper insights.