Scalable Startup Entrepreneurship: Your 2025 Growth Game Plan for Success

You can feel it before you see it.

The Slack pings get louder. The roadmap gets blurrier. The team’s doing more, but results feel… slower. Your startup's not failing, but it is outgrowing the way it was built.

You’re not alone in this, either. A staggering 78% of startups fail during the scale-up stage, after they’ve already found product-market fit. Why? Because growth and scalable startup entrepreneurship are two very different games.

The former is about momentum. The latter is about building systems that hold, even when you 5x your team, your revenue, and your complexity.

We wrote this guide for that exact stage: when you’re past the “will this work?” phase and squarely in the “how do we not break it as we grow?” phase. You’ll learn what actually fuels startup growth beyond the early wins, how to design for scalability, and what separates a fast-growing startup from a truly scalable one.

How to know if you are ready for scalable startup entrepreneurship

Just because your startup is growing doesn’t mean it’s ready to scale. Growth is momentum. Scalability is structure. Mistaking one for the other is how promising startups burn cash, break systems, and stall out.

Scalable startup entrepreneurship means building in a way that can handle 10x customers, complexity, and team size, without everything falling apart. To know if you're truly ready, you need to pressure-test your business model, not just how fast revenue’s growing.

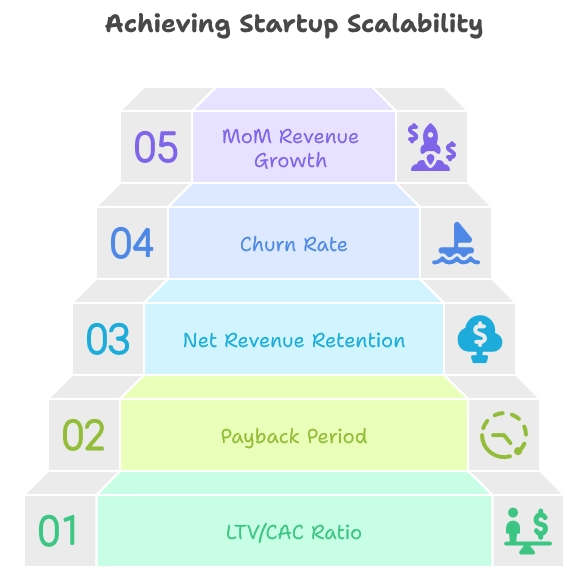

These five metrics are how you will know if you are ready to scale, as well as let seasoned operators and investors know that your startup growth strategy is actually sustainable.

Sign #1: LTV/CAC > 3

LTV (customer lifetime value) and CAC (customer acquisition cost) are the single most important ratios to know if your startup can scale profitably. If it costs you ₹100 to acquire a customer and you make ₹300 from them over their lifetime, you're in a healthy place.

This 3x threshold is what most investors and operators look for because it gives you enough margin to absorb operating costs and market shifts, especially when you're trying to build a scalable startup entrepreneurship model. Anything lower, and you’re just growing losses at scale.

How to measure LTV/CAC LTV = Average revenue per user × gross margin × customer lifespan CAC = Total sales + marketing spend ÷ customers acquired Then divide LTV by CAC

Read More about Unit Economics and how to calculate it.

Sign #2: Payback period ≤ 12 months

Your payback period tells you how quickly you recover what you spent to acquire a customer. A scalable business, beyond just growth, is also about cash flow that can keep up.

If you’re waiting 18 months to earn back CAC, you’ll always be dependent on external funding. That’s why a 12-month benchmark is the cutoff most scale-stage investors use when evaluating a startup growth strategy. It shows your model is capital-efficient enough to reinvest in growth, not just survive it.

How to measure payback period Payback = CAC ÷ (Monthly gross profit per customer)

Sign #3: NRR > 120%

Net revenue retention (NRR) shows whether your current customers are not only staying but expanding. A startup that scales well[1] doesn’t just bring in new business; it gets more from existing accounts.

If your NRR is over 120%, that means your customers are upgrading, adding users, or spending more over time. It’s one of the clearest signs of product-market fit and a must-have indicator in any scalability startup plan. Investors love it because it reflects compounding revenue, the kind that scales without constant acquisition.

How to measure NRR NRR = [(Starting MRR + expansions – downgrades – churn) ÷ Starting MRR] × 100

Sing #4: Churn < 5% per quarter

Churn is the percentage of customers who stop doing business with you in a given period, and if you’re losing more than 5% every quarter, scaling will only make the cracks deeper.

Healthy churn shows that your customers find recurring value meaning, which is foundational to building scalable business models.

It also keeps your team focused on growth, not just replacement. 5% quarterly churn is the industry benchmark for sustainable startup expansion, especially in SaaS and subscription-based models.

How to measure churn Customer churn = (Customers lost ÷ Starting customers) × 100 Revenue churn = (MRR lost ÷ Starting MRR) × 100

Sign #5: MoM revenue growth ≥ 15%

Month-over-month (MoM) revenue growth tracks whether your startup is gaining real momentum. When you're scaling, consistent growth matters more than one-off spikes. That 15% monthly benchmark isn’t arbitrary; it’s what most fast-growing startups hit post–product–market fit before raising their next round.

It proves that your startup growth strategy is driven by a repeatable engine, not founder effort or last-minute campaigns. For leaders figuring out how to scale a startup, this is a baseline to watch closely.

If you’re struggling to build that kind of growth engine, GrowthJockey helps post-PMF teams install repeatable GTM systems that support compounding momentum, with no burnouts or shortcuts.

How to measure MoM revenue growth MoM Growth = [(This month’s revenue – Last month’s revenue) ÷ Last month’s revenue] × 100

Solidify your startup's economic engine

Passing a scale-readiness check is step one. Step two? Making sure your business model won’t collapse under its own weight.

That means tightening your core economics, such as how you price, how quickly you recover acquisition costs, and whether your margins actually improve as you grow. If this is weak, even fast growth will feel like pushing a car uphill.

So, where do you start? Focus on these two levers that shape long-term scalability:

1. Price like you’re building for scale

The fastest way to increase LTV without touching CAC? Redesign your pricing. If you’re stuck on flat plans or one-size-fits-all packages, you’re probably leaving money on the table.

Scalable startups often move to tiered or usage-based pricing that lets revenue grow with customer usage. Test high-anchored plans, charge for value-driving features, and explore expansion revenue through add-ons or seat-based upgrades. Pricing should stretch as your customers do.

2. Shorten your payback with smarter onboarding and upsells

Instead of slashing CAC, focus on recovering it faster. Look at how long it takes for a new customer to start paying off. Can you improve your customer onboarding so they start seeing value (and paying more) earlier? Can you offer a quick upsell or a small add-on in the first 30–60 days?

Faster payback means you can reinvest that money into more growth, without constantly chasing funding.

Ready to tighten your core economics? Grab our scale-readiness checklist from above. It helps you keep key metrics front and centre as you build scalable business models.

Build systems that scale without bottlenecks

Even the strongest economic engine can stall if the rest of your business isn’t built to handle growth. Once your pricing, margins, and payback are in a good place, the next challenge isn’t financial, it’s operational.

This is also where many scalability startups fall apart. Teams grow, decisions pile up, and suddenly everything that worked with five people starts breaking down at fifty.

Building scalable business models means scaling both revenue and responsibility. Here's how to do it without drowning in complexity.

Implement minimum-viable bureaucracy

As headcount increases, so does confusion: who owns what, how decisions get made, and where each doc is. Minimum-viable bureaucracy means adding just enough process to provide structure, but not so much that it slows everyone down.

Use simple tools like Notion for SOPs, Slack channels with clear naming for team ownership, and Loom to share updates without meetings. Keep working units small (ideally under 8–10 people) to limit overhead and reduce cognitive overload as you scale.

Automate low-leverage workflows (billing, onboarding, CS playbooks)

Not every task needs a human. As you grow, repetitive work, like invoicing, customer onboarding, or support replies, starts to eat up valuable time. Automate using AI what doesn’t need a strategy.

Use tools like Chargebee to automate billing, Zapier to connect apps, and Intercom or Help Scout to handle customer support. Create simple onboarding guides in Notion or Google Docs, and use ready-made email templates for FAQs, check-ins, and renewals.

This is essential for any scalability startup looking to scale without constantly adding headcount.

Step back from the weeds as a founder

Early on, you’re in every Slack thread, sales call, and product decision. But at scale, that becomes a bottleneck.

Founders need to shift from operator to strategist: hiring experienced leads, letting go of micro-decisions, and focusing on what drives long-term growth. If you don’t get out of the way, your team can’t step up, and your business can’t scale beyond you.

Design rituals that scale culture

Culture doesn’t scale unless you design it to. Rituals like writing things down, documenting decisions, and working asynchronously help your team move fast without needing constant meetings or founder sign-off.

These habits reduce friction, increase accountability, and keep things aligned. When done right, they act as invisible systems that hold your company together as it grows.

Of course, you don’t need to figure all this out alone. As your systems, teams, and tools grow, so does the disorder. That’s where platforms like Intellsys come in.

Instead of drowning in spreadsheets and disconnected dashboards, this tool helps growth teams unify their data, automate reporting, and act on insights faster. Its AI Copilot handles the grunt work of collecting, organising, and interpreting information.

Intellsys makes sure your data works for you, not the other way around.

Smart funding options to support your startup expansion

Even if your revenue engine is working, scaling often needs capital, especially if you’re hiring fast, entering new markets, or building tech that doesn’t pay off immediately. But raising money isn’t the hard part. Raising the right kind of money is.

Not every funding model fits every scalability startup, and the wrong one can create pressure that breaks your growth rhythm. Before you jump into a raise, understand what each option actually means and what it asks of you.

Venture, growth debt, or revenue-based financing?

-

Venture capital: This is when investors give you money in exchange for equity (a % of your company). It’s great if you’re trying to scale fast and dominate the market. But the catch? You give up partial control and are expected to grow aggressively to hit big returns. High pressure, high reward.

-

Revenue-based financing: Here, you raise funds without giving away equity. Instead, you agree to pay back a portion of your monthly revenue until the total loan is cleared. It’s flexible, so you pay more when you earn more, but it also caps how much you can reinvest into growth since some of your revenue is always going to repayments.

-

Growth debt: This is a loan you qualify for if your business has strong, predictable cash flow. You don’t lose equity, but there’s risk, where if you miss a payment, it could impact your credit, cash flow, or even force you into unwanted restructuring. That’s why it’s only a good fit if your startup has steady, predictable income.

How to decide?

Ask: Do I need speed or sustainability? Am I okay with dilution? Do I have predictable cash flow? Match funding to your reality and not someone else’s.

Secondary liquidity

This option is for the founders who've poured everything into the company but haven’t paid themselves in months. You’re growing, fundraising, maybe even hiring a leadership team… but personally? You’re broke, and it’s getting harder to make clear-headed decisions.

Secondary liquidity lets you sell a small portion of your shares during a raise so you get some cash without stepping away. Most investors understand that a founder who’s not in survival mode is better for the company long-term.

But this move isn’t just for struggling leaders. It can also be a smart way to offer partial exits to early investors who’ve been locked in for years. In fact, 37% of founders[2] surveyed by Inc42 said secondary transactions are now a key tool to provide liquidity to early backers.

Plus, if you’re also thinking ahead about your exit strategy, secondary liquidity can give you the financial breathing room to make smarter decisions down the road.

Regardless of your motive to choose this option, remember:

Taking a secondary isn't a sign of weakness; it’s a move to stay in the game longer. Scaling a company is a marathon. If giving yourself some financial room means you make better decisions, protect your health, and lead with clarity, that’s not optional. That’s part of growing a startup the smart way.

Funding decisions can make or break your startup’s scalability. To make sure you’re financially ready to grow, download our scale-readiness checklist from above. It’ll help you keep key metrics and cash flow in check as you raise and expand.

What breaks on the way up: Obstacles of scalable startup entrepreneurship

You can learn how to scale a startup, measure all the right metrics, and pick the right funding model. However, scalable startup entrepreneurship also means having to avoid the subtle landmines that can derail momentum even when everything looks "fine" on paper. In fact, if you look at the proof, only 4.6% of startups[3] actually evolve into scale-ups.

Which is why it’s so important to avoid the following four growth-stage traps:

-

Expanding the product, not the value: At scale, it’s tempting to keep shipping just to look productive. But every feature has a cost: support, UX complexity, and team focus. If it doesn’t improve retention, monetisation, or user experience, it’s just more surface area to maintain.

-

Building for your ego, not your users: That slick analytics suite or flashy redesign might feel like a win, but is it solving real user pain, or just scratching a personal itch? Your startup growth strategy will only work when it's grounded in customer value and not optics.

-

Fixating on the next raise: Fundraising should give you fuel, not cover up a weak engine. If you’re betting on your next round to fix burn, margins, or growth gaps, you’re not scaling, you’re stalling with a buffer.

-

Assuming what worked will keep working: Just because one channel got you your first 500 customers doesn’t mean it’ll take you to the next 5,000. Every stage of growth requires revalidating your assumptions and sometimes, unlearning what you swore by.

Spotting these early is half the game. Because when you’re scaling, problems rarely explode; they pile up quietly until something breaks, and by then, you’ve lost momentum. Avoiding these traps is just as much a part of scalable startup entrepreneurship as growth tactics or metrics ever will be.

If you're scaling, build what lasts

Does scaling stop at making one big leap? No! It’s a series of uncomfortable, high-stakes decisions. You need to know when to step on the gas, when to rebuild the engine, and when to just hold the wheel steady.

This is the real challenge of scalable startup entrepreneurship: not starting, but evolving, without losing momentum or burning out your team. You’ll hit breaking points. That’s normal. What matters is whether your systems, economics, and mindset are built to absorb it and turn it into actual startup growth.

If you’re looking for a way to accelerate your journey post-MVP, GrowthJockey helps you do just that. We work with post-validation ventures, especially within enterprise settings, to fast-track scaling through data-driven GTM strategies, AI-powered experimentation (via Intellsys.ai), and lean execution sprints.

With a focus on building scalable business models and implementing data-driven strategies, we help founders like you move from good to great, quickly.

FAQs on scalable startup entrepreneurship

How do you measure entrepreneurship?

You don’t measure entrepreneurship by how cool your pitch deck is. It’s about outcomes: how well you're solving a real problem, whether customers are sticking around, and if you’re building something that can grow. In scalable startup entrepreneurship, success looks like traction that doesn’t fall apart when you double down.

How to scale a business up?

Scaling a business means taking what already works and making it work at 10x. You’ll need systems that don’t collapse under growth, a clear GTM motion, and the margins to support it. If you’re serious about how to scale a startup, focus less on hacks and more on sustainable execution.

What is scale-up in entrepreneurship?

A scale-up is what comes after a startup. According to Iberdrola, scaleups are companies that grow more than 20% annually for three years straight, either in revenue or team size. It’s the point where you’re no longer just validating, you’re expanding.

How to measure entrepreneurial skills?

There’s no single scorecard, but there are a few proven ways to gauge it:

-

Self-assessment tools like surveys or reflection frameworks help founders evaluate their own strengths across things like risk-taking, resilience, and creativity.

-

Behavioural observation in real scenarios, like how you pitch, problem-solve, or lead under pressure, says a lot.

-

Competency-based interviews can dig deeper into past decisions and founder instincts.

-

Psychometric tests (like Big Five or DISC) are sometimes used in founder coaching.

-

Many use a blended approach, combining these with real-world performance metrics such as team retention, customer stickiness, and ability to pivot.

But to be honest, in practical applications of entrepreneurship, it's less about theory and always more about how consistently you execute as things scale.

How to scale a business: strategies and tips

Start with the basics. Can you consistently acquire customers, and do they stick around? If yes, focus on one channel that works and double down. Don’t hire too fast or overbuild. Clean up your onboarding, tighten your margins, and make sure the business runs without needing daily firefighting. That’s what makes a company actually scalable, not just growing for the sake of it.

What are the stages of scaling a startup?

Most startups scale in phases. First comes product-market fit, then you build repeatable systems for marketing and delivery. After that, it’s about growing the team, entering new markets, and defending margin while you grow. Each stage forces new decisions on funding, focus, and structure, and each one will test whether you're really ready for startup expansion or still ironing out the basics.