10 Types of Startup Accelerators and Which One’s Right for You

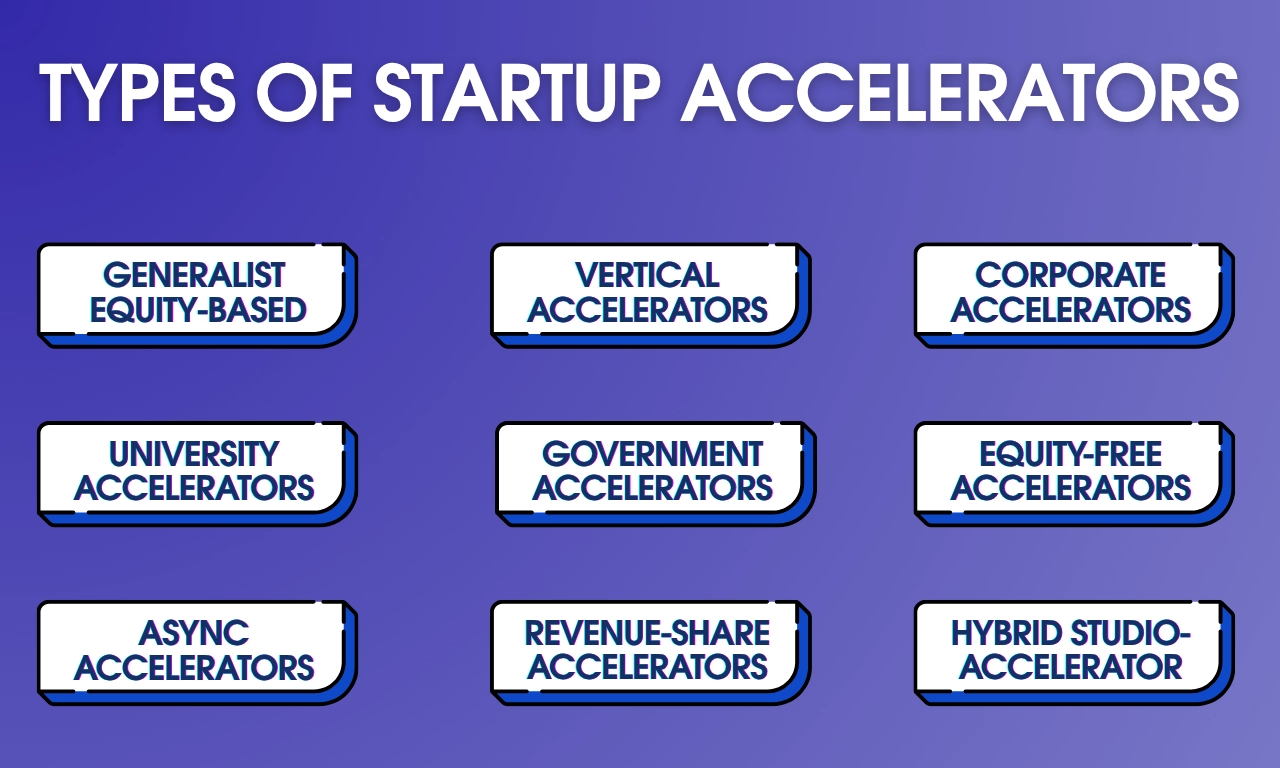

Startup accelerators come in many types, and the right one for you depends on your startup stage, funding needs, and growth goals:

-

Generalist - Classic equity-based programs with strong brand value and investor access.

-

Sector-specific - Tailored for industries like fintech, healthtech, or climate.

-

Corporate - Run by enterprises, offering real pilots and customer access.

-

University-backed - Built for deeptech/R&D founders with lab and grant access.

-

Government-led - Grants and infrastructure for early-stage or regional startups.

-

Non-dilutive - Offer support and capital without taking equity.

-

Remote/Async - Fully virtual programs ideal for distributed teams.

-

Revenue-share - Charge a fee or % revenue instead of equity.

-

Hybrid studio - Combine capital, team, and execution support.

-

Community-led - Founder-run micro-accelerators focused on real GTM help.

You’re growing your startup business, and everyone’s throwing the same advice at you: “Join an accelerator!” Sounds great in theory, but which one actually makes sense for your startup?

You see, a startup accelerator is designed to fast-track your growth with funding, mentorship, structure, and investor access. But with so many types of business accelerators out there, some equity-based, some sector-specific, it’s hard to know what’s worth your time (and your cap table).

The global accelerator market is growing fast too, set to hit $5.11 billion by 2025, which only makes choosing the right one even more important.

This blog breaks it all down. You’ll learn how to pick the right startup accelerator program for your stage, goals, and growth path without falling for the hype or giving up more than you gain.

Business accelerators vs. incubators vs. venture studios: What’s the difference?

Before we take a look at the different types of business accelerators, let’s take a step back.

You might not even need an accelerator. Depending on your stage, the real question might be business incubator vs accelerator or even venture studio. Knowing the difference will save you from wasting time, equity, and effort on a path that isn’t built for your stage.

Here’s a quick breakdown:

-

Accelerator: A fixed-term, cohort-based program (usually 3-6 months) that offers a small investment, hands-on mentorship, and structured support. Typically, in exchange for 3-10% equity. These programmes are designed to boost growth fast, especially if you’ve already built an MVP or gained early traction and want to accelerate fundraising or go-to-market.

-

Business incubator: A more flexible, often non-dilutive setup focused on idea validation, early prototyping, and finding product-market fit. Best if you’re still figuring out what to build, handling startup registration, or testing early prototypes.

-

Venture studio: A hands-on model where the accelerator company co-creates your startup from scratch, offering a founding team, funding, and execution support in exchange for a larger equity stake. Great for zero-to-one founders who have an idea but no team or product yet.

For a quick comparison, you can also check out the table below:

| Program type | Best for | Equity involved? | What you get | Ideal stage |

|---|---|---|---|---|

| Startup accelerator | MVP-ready startups needing speed, structure, and funding | Yes (3-10%) | Mentorship, small check, demo day, investor access | Early traction to PMF |

| Business incubator | Founders validating ideas or building early prototypes | Often no | Workspace, basic mentorship, early-stage support | Idea to MVP |

| Venture studio | Zero-to-one founders with ideas but no team/product | Yes (15-50%) | Full team, capital, playbooks, co-building | Idea stage, no execution team |

10 different types of startup accelerators: Find the best fit for your idea

You already know how accelerators work from the earlier section - cohort-based, fast-paced, and equity-linked. But how do they create value? That varies wildly.

Some programmes flood you with investors. Others quietly get you enterprise pilots. A few are glorified Slack groups. That’s why choosing the right startup accelerator program starts with knowing what kind of value you actually need and what each model is built to deliver.

Below, we break down the types of business accelerators you’ll come across, who they’re right for, and what to expect if you get in:

1. Generalist, equity-based accelerators (like YC or Techstars)

These are your classic startup accelerator models: short, intense, and equity-heavy. They offer small funding (e.g. $125-$220K) in exchange for 5-7% equity.

The biggest benefit is the brand halo, so think investor access, warm intros, and credibility. But don’t expect deep operational help. Ideal if you're in B2B/B2C with early traction and looking for signal.

2. Sector-specific or vertical accelerators

Tailored for industries like fintech, healthtech, climate, or AI, these accelerator companies offer mentors, networks, and compliance know-how specific to your space.

While they may not have YC-level brand value, they can fast-track pilots and help you avoid industry-specific landmines. Great for regulated or niche markets with steep learning curves.

3. Corporate accelerators

Run by large enterprises, these accelerators offer more than mentorship by giving you access to real customers, data, and potential distribution channels. They're perfect for startups chasing enterprise pilots.

The catch? These accelerators usually follow the host company’s agenda. You’ll be expected to align your product or use case with their roadmap, which might limit flexibility. They also carry less investor cachet compared to brand-name VC-backed programmes. But if revenue is the priority, this could be gold.

4. University and research-backed accelerators

If you’re building in deeptech, biotech, or any R&D-heavy space, these programmes give you lab access, grant support, and tech transfer help.

Many are non-dilutive or offer low-equity capital. Especially valuable for IP-heavy or science-first startups spinning out of academia or national research hubs.

5. Government and economic development accelerators

These are typically region-specific and mission-aligned, offering grants, infrastructure, and market access. Accelerators like these are very useful in countries like India, where private capital is often concentrated in later-stage or metro-based ventures.

For example, WTFund[1] provides ₹20 lakh in non-dilutive capital for founders under 25, making it one of the few seed fund startup programs in India built to support first-time entrepreneurs early.

They may lack investor clout, but they're a strong choice if you're optimising for cash without dilution.

6. Non-dilutive or equity-free accelerators

Some of the best-kept secrets in the startup world, these programs provide capital, resources, and mentorship without touching your equity.

Often found in healthcare, climate, or social impact sectors. They’re ideal if you're pre-seed and want to prove traction before raising a priced round.

7. Remote or async accelerators

Perfect for distributed teams or solo founders who don’t want to relocate. These programmes still offer structured sprints and mentorship, just without the in-person hassle.

They’re pretty valuable if you’re building from outside major startup ecosystems, where in-person programmes may not be accessible. Just make sure to vet the quality of support, mentor engagement, and alumni network before applying.

8. Revenue-share or fee-based accelerators

If giving up equity isn’t an option, consider accelerators that charge a flat fee or take a small revenue share. These models appeal to bootstrapped or profitable startups. You pay in cash, not shares, so the upside stays with you. Useful if you just need guidance, not funding.

9. Hybrid studio-accelerator models

These are part accelerator, part business incubator, part co-founder. You’ll get a small team, prebuilt systems, and capital, but give up more equity than standard programmes. Ideal if you’ve got a strong idea but no product or team yet.

Studios like Forum Ventures and Blockchain Founders offer this model to help you turn an idea into a functioning startup company, even if you're starting solo.

10. Community-led or operator micro-accelerators

Forget big names! These scrappy programmes are run by angels, founders, or DAOs who’ve built startups themselves. Less structure, but way more tactical help. They’re small, intense, and built around shipping fast, not just raising. If you care more about GTM execution than investor polish, this is your scene.

How to choose the right type of business accelerator for your startup

Now you know the different types of business accelerators out there. But how do you figure out which one’s actually right for you?

It all comes down to where you are, what’s blocking your growth, and how much equity you’re willing to part with. Use the breakdown below to filter fast and make a smart decision before applying to any startup accelerator program.

Pro Tip: Ask yourself: Do I need capital, customers, or clarity?

If it's capital, go for a VC-backed accelerator. If it's customers, a corporate or vertical program will get you closer to revenue. If it's clarity, on your product, idea, or team, you’re likely better off with a business incubator or venture studio.

5 top startup accelerators and their types

If you’re still unsure where to start, here are five of the most credible startup accelerator programs you can consider.

Each belongs to one of the types of business accelerators we discussed earlier:

1. GrowthJockey (Hybrid studio-accelerator)

Not your traditional startup accelerator in India, GrowthJockey partners with early-stage startups to co-build traction from the ground up. They work closely with early-stage startups to set up scalable growth engines across product, content, and GTM.

The team brings execution muscle + strategic clarity, powered by their proprietary growth intelligence platform, Intellsys AI. If you’re past validation but need a focused, outcome-driven, top startup accelerator in India, this is your move.

2. JioGenNext (Corporate accelerator)

Backed by Reliance Jio, this startup accelerator focuses on enterprise-ready products, offering market access and pilot opportunities with India’s largest corporate ecosystem.

This accelerator is ideal if you’re chasing pilots, procurement, or distribution within India Inc.

3. Brinc (Sector-specific)

A global accelerator supporting climate tech, medtech, and hardware startups. Brinc mixes non-dilutive capital with equity-based investment and helps mission-led teams scale manufacturing and sustainability-focused products.

Best for hardware or impact-driven startups building physical products.

4. Startup Chile (Government/non-dilutive)

A government-backed programme providing non-equity grants, global mentorship, and soft-landing for international startups.

It’s ideal for early-stage founders seeking to validate their business without relinquishing equity.

5. MIT delta v (University-backed accelerator)

This accelerator out of the Martin Trust Centre for MIT Entrepreneurship is as legit as it gets. MIT delta v takes student-led startups through an intense summer programme that culminates in Demo Day, with top-tier mentorship, equity-free funding, and access to MIT’s global network.

Great if you are a student-led team with MVPs who want structured acceleration and equity-free backing from a top-tier innovation hub.

Quick tip: Before applying, contact a recent alum who didn’t go viral post-demo day. Ask what really moved the needle and what didn’t. You’ll learn more from their quiet reality than the program’s highlight reel.

These aren't your only options, though. You can also explore more startup accelerators here if you're looking for programs beyond these five.

Red flags to watch for in any startup accelerator program

Joining a startup accelerator program is a big move. But before you get too excited about demo days or mentor lists, make sure you’re not walking into a shiny trap.

Here are a few signals that should make you pause or walk away entirely:

-

Vague or confusing terms: If they can’t clearly explain what you’re giving up (equity, pro-rata, MFN clauses, advisory shares), something’s off. You shouldn't need a lawyer to decode a three-month program.

-

Pay-to-pitch or sneaky upsells: Charging for investor intros, demo day slots, or “mandatory” services is a red flag, especially if they can’t show the results.

-

No proof of outcomes: If you can’t find real alumni wins, warm intros, or even named mentors, it’s probably not worth your cap table. You don’t want to be the test case.

-

No support beyond demo day: Ask recent alumni what happened after demo day. The real value often starts after the program ends: follow-on intros, check-ins, maybe even bridge funding. If recent alumni say the support stopped once the demo videos were posted, that’s a sign the accelerator's more focused on optics than outcomes.

Choosing the right type of business accelerator starts with knowing your gap

Choosing the right accelerator can be overwhelming, but honestly, it all comes down to clarity. You do not need to overthink the decision. You just have to know what is missing in your business right now and choose the model built to close that gap.

If you need early structure, a business incubator can help you get grounded. If the goal is growth, funding, or customer access, a startup accelerator with the right focus will get you there faster.

Past validation and focused on scale? GrowthJockey offers a hybrid accelerator model designed to close execution gaps. With strategy, systems, and our growth platform Intellsys, we help early-stage teams turn traction into measurable growth.

FAQs on types of business accelerators

What are the top 5 startup accelerators in the world?

Some of the most respected startup accelerator programs globally include Y Combinator, Techstars, 500 Global, Plug and Play Tech Centre, and Antler. These companies are known for their strong alumni outcomes, global networks, and access to top-tier investors.

What is the business model of an accelerator?

Most startup accelerators operate on an equity-based model, offering funding, mentorship, and access to networks in exchange for 5-10% ownership. Others run programs supported by corporates, governments, or universities, focusing on ecosystem building rather than financial returns.

How many startup accelerators are there?

As of 2025, there are over 7,000 startup accelerators and business incubators operating worldwide. These include a mix of VC-backed programs, non-dilutive government accelerators, university-led initiatives, and corporate-backed innovation hubs.

How do accelerators select startups?

Accelerators typically select startups based on team strength, market potential, early traction, and fit with the program’s focus. Each startup accelerator has its own selection criteria, but most look for high-growth potential, a scalable idea, and founders who can execute fast.