Guide to Amazon Seller Charges: Fees, Ad Costs & Commisions

Selling on Amazon unlocks a huge customer base, but it's vital to understand the fees involved. Amazon's marketplace isn't free – there are commissions and service fees that can eat up 30–40% of your revenue if you're not careful. In this comprehensive guide, we break down Amazon seller charges (with a focus on India) and share tips to minimize them while growing your business. Whether you're comparing Amazon vs Flipkart for sellers or just starting out, knowing these costs will help you price and plan effectively.

Types of Amazon Seller Fees

Amazon seller fees fall into a few main categories:

- Referral Fee (Commission): A percentage cut Amazon takes on each sale.

- Closing Fee: A flat fee per unit, varying by item price and shipping method.

- Shipping/Fulfillment Fee: Charges for delivery (Easy Ship or FBA) based on weight and distance.

- FBA Service Fees: If you use Fulfillment by Amazon, extra fees for storage, packing, etc.

- Advertising Costs: Optional spending on Amazon Ads (like Amazon PPC campaigns) to boost visibility.

- Other Fees: Miscellaneous charges (high-volume listing fees, refund fees, etc.) that may apply in specific cases.

Here is a table giving you a complete breakdown of the costs associated with selling on Amazon.

| Fee Category | Description | Rate / Charge (Approx.) |

|---|---|---|

| Referral Fee | Commission charged on the total sale price; varies by product category. | 2% to 30%+ (Mobiles: ~5%, Electronics: ~8–10%, Fashion: ~15–18%, Warranties: ~30%) |

| Closing Fee | Flat fee per unit based on item price and fulfillment mode. | ₹5 to ₹65 (₹5–25 for low-priced items; ₹50+ for items above ₹1,000) |

| Weight Handling (Easy Ship) | Shipping fee based on weight and delivery distance (Local, Regional, National). | ₹30 to ₹150+ (e.g., ~₹43 for 500g Local; ~₹65 for 500g National) |

| FBA Fulfillment Fee | Combined charge for picking, packing, and shipping under FBA. | ₹40 to ₹180+ (Varies by size: Standard, Heavy, Bulky) |

| FBA Storage Fee | Monthly charge for warehouse storage space used by inventory. | ₹45–₹50 per cubic foot/month (Higher during festive peak seasons) |

| Marketplace Fee | Flat per-order fee usually shown to customers during checkout. | ₹5 (Inclusive of tax; applied to most orders) |

| Advertising (PPC) | Optional spend on Sponsored Products, Brands, or Display ads. | Variable (Controlled by seller; tracked via ACoS & TACoS) |

| Refund Admin Fee | Processing fee retained by Amazon when a refund is issued. | Lesser of ₹500 or 20% of the original referral fee |

| Removal / Disposal Fee | Fee to return unsold FBA inventory or dispose of it. | ₹10 to ₹30+ per unit (Depends on size and weight) |

| High-Volume Listing Fee | Charge for maintaining a large number of inactive listings. | ₹0.50 per dormant listing (After 12 months of no sales) |

| Long-Term Storage Fee | Additional charge for inventory stored in FBA for over 365 days. | Monthly surcharge based on volume or per-unit minimum |

| GST on Fees | Government tax applicable to all Amazon service fees. | 18% (Applied on top of all Amazon charges) |

Together, these fees typically range from 20% to 30% of each sale in total[1] – and can be higher for certain categories or heavy use of services. Below, we detail each fee type and how it impacts your bottom line.

Amazon Referral Fees (Sales Commission)

Referral fees are Amazon's commission on every sale. Amazon India charges a fixed percentage of the total item price (including shipping) for each product sold. This percentage varies by category and can be as low as 2% or as high as ~30%+ in extreme cases:

Common Range

~5% to 15% for most product categories. For example, Electronics and Books have relatively lower rates, while Fashion and Accessories often carry around 15%.

Lower-Priced Items

Many categories have tiered rates that are lower for cheaper items. For instance, books under ₹250 have just a 2% fee, rising to 12.5% for books above ₹1000. Amazon incentivizes affordability by reducing fees on low-price goods in some categories.

Highest Rates

Niche categories like jewelry or warranties carry higher fees. Gold coins have a tiny 2% fee, but general fashion jewellery can be ~22–24%, and extended warranties incur about 30% commission.

To illustrate the variation, here's a sample of Amazon.in referral fees by category:

| Category | Referral Fee |

|---|---|

| Books | 2% (item ≤ ₹250); 4% (₹251–500); 9% (₹501–1000); 12.5% (>₹1000) |

| Women's Kurtis | 15% (item ≤ ₹300); 16.5% (₹301–1000); 18% (>₹1000) |

| Mobile Phones | 5% flat |

| Fine Jewelry | 2.5% for gold coins; 5–10% for other jewelry |

| Warranty Services | 30% flat |

Table: Examples of Amazon India referral fees by category (as of 2025). Lower-priced items often have reduced rates in certain categories.

As you can see, Amazon's commission depends on what you sell and at what price. It's crucial to factor this fee into your pricing strategy. For instance, if a category's referral fee jumps above a certain price point, you might price just below that threshold to save on fees. Always consult Amazon's latest fee schedule for your category, as rates can update periodically.

Fixed Closing Fees

In addition to the referral commission, Amazon India charges a fixed closing fee on each order, based on the item's price and fulfillment method. This is essentially a flat charge per unit sold. For most items on Amazon.in (especially non-media items), the closing fee is tied to price slabs. For example, as of 2025:

- ₹0 – ₹250 item price: ₹5 closing fee (Easy Ship), ₹7 (Self-Ship), or ₹25 (FBA)

- ₹251 – ₹500: around ₹9 (Easy Ship), ₹20 (Self-Ship), etc.

- ₹501 – ₹1000: around ₹30 (Easy Ship), ₹36 (Self-Ship), etc.

- ₹1000+: roughly ₹50–65 for higher price brackets

These fees are per unit sold and are in addition to the referral percentage. Note that FBA (Fulfillment by Amazon) closing fees can differ slightly from Easy Ship fees for the same price range. Also, certain categories like books or media in other marketplaces have their own fixed fees (e.g. Amazon US charges $1.80 closing fee on media items), but in India the price-based closing fee applies broadly.

Why does Amazon charge a closing fee? It covers transactional processing costs and is somewhat like a base charge for using the platform per sale. For sellers, this means very low-priced items still incur a minimum fee. For example, selling a ₹200 item via Easy Ship would have ₹5 closing fee – a non-trivial 2.5% of the price in addition to the referral cut. Always account for the closing fee in profitability calculations, especially if your product price is low.

Shipping & Fulfillment Fees (Easy Ship / FBA)

If Amazon is handling the delivery of your product (which is common in India through the Easy Ship program or through FBA), there will be shipping fees (weight handling charges). These are based on the weight and dimensions of the item and the delivery distance:

Easy Ship Weight Handling Fee

For sellers using Amazon's logistics to ship orders from their location, Amazon charges a fee by weight slab and shipping zone (Local, Regional, National). For example, a standard 500g package might incur about ₹30–₹50 in shipping fees locally, and higher for national delivery. An 800g package to a regional zone costs around ₹68 via Easy Ship. Heavier or bulky items have higher fees.

Self-Ship

If you handle your own shipping (self-fulfillment), Amazon doesn't charge you a shipping fee – but then you bear the courier cost directly. In that case, you'd factor your shipping cost into the item price or charge the customer.

Fulfillment by Amazon (FBA)

Using FBA means Amazon stores your inventory and delivers orders for you. FBA fees come in two parts: fulfillment fees and storage fees. The fulfillment fee is like a combined picking, packing, and shipping charge per unit.

It depends on item size/weight – for a small item it may be around ₹40–₹80, whereas a large item can be a few hundred rupees. (For example, standard small items might be ~₹50, while very large items can incur ₹150+ each in fulfillment fees.)

Storage fees for FBA are monthly charges for holding your stock in Amazon's warehouse. In India this is about ₹45 per cubic foot per month of storage used (rates can be higher during festive season months). If your inventory stays for long, Amazon may also levy long-term storage fees after 365 days.

Example: You sell a product weighing 700g using FBA to a customer in another region. Amazon will charge, say, ₹60 as the weight handling/fulfillment fee for shipping, plus the picking/packing fee (often ₹14 per unit for standard-size items), and a small storage cost if the item sat in the warehouse. So, on top of referral commission, you'd see perhaps ₹74 deducted for fulfillment on that order.

The key is that fulfillment fees are typically usage-based – the heavier or bulkier your product, and the farther it ships, the more you pay. Amazon provides rate cards for Easy Ship and FBA so you can estimate these charges. To optimize costs, try to keep packaging compact (to reduce volumetric weight) and consider storing inventory in-region to serve local orders faster. Also, if an item is very large/heavy, sometimes shipping yourself via a cheaper freight arrangement could save costs.

Other Amazon Fees to Know

Beyond the core fees above, Amazon may charge a few additional fees in certain scenarios:

Amazon Marketplace Fee (₹5 per order)

As of mid-2025, Amazon.in introduced a flat ₹5 "marketplace fee" on every customer order. This is charged to the buyer as a separate line item at checkout (inclusive of tax). It's not deducted from the seller payout, but sellers should be aware of it since it effectively makes customers pay a tiny bit extra per order.

(Exceptions exist – e.g. the ₹5 fee doesn't apply to Prime Video rentals, gift cards, or certain services.)

High-Volume Listing Fee

If you have an extremely large catalog of listings that haven't sold in 12+ months, Amazon may charge a small fee (~₹0.5 or so) per dormant listing beyond a threshold. Regularly cull inactive products to avoid this.

Rental Book Service Fee

Applicable only if you rent textbooks via Amazon (₹5 per rental in the US; not common on Amazon.in).

Refund Administration Fee

When you refund a customer, Amazon returns the referral fee to you minus a small portion. Typically they keep the lesser of ₹500 or 20% of the referral fee as a processing fee on refunds.

Removal/Disposal Fees

If you use FBA and later want to remove your unsold stock from Amazon's warehouse, they charge a fee per item for removal or disposal (e.g. ₹10 per standard item for return to you).

GST

While not exactly a "fee", remember that Amazon's fees in India are subject to an 18% GST. The charges we've quoted (₹ amounts) usually exclude GST, which gets added to your seller invoice. You can claim input credit if applicable, but it's a cash flow point to note.

Most of these additional fees won't affect new or small sellers too much, but it's good to be aware as your business scales. For example, if you're selling hundreds of products, keep an eye on inventory age to avoid long-term storage or listing fees.

Advertising Costs on Amazon

Besides the fees Amazon charges per sale, many sellers also incur costs for advertising on Amazon. Using Amazon's advertising platform (Amazon Marketing Services, now the Amazon Ads console) can dramatically boost your product visibility – but it comes at a price, which you control as a budget rather than Amazon mandating it.

Types of Amazon Ads

Sellers can run pay-per-click campaigns such as Sponsored Products, Sponsored Brands, and even Sponsored Display Ads (visual banners). With these, you bid on keywords or audiences, similar to Google Ads. Every click on your ad costs you money, and it's deducted from your seller account balance. The cost per click (CPC) depends on how competitive the keywords are – popular product keywords can be pricey.

Advertising spend is optional, but in competitive categories it's often necessary to jumpstart sales. Many Amazon sellers aim for an ACoS (Advertising Cost of Sales) that is profitable - for example, spending 10% of your sales revenue on ads. There's also TACoS (Total Advertising Cost of Sales), which measures ad spend as a percentage of total sales (including organic sales). Keeping an eye on TACoS vs ACoS is crucial for balanced growth – ACoS tells you immediate ad efficiency, while TACoS shows if your overall business is scaling efficiently with ads.

Pro Tip: ACoS and TACoS metrics can guide your ad strategy. A rising TACoS means ad spend is growing faster than sales – possibly unsustainable. The goal is often to lower TACoS over time by boosting organic sales (through better Amazon SEO and ratings) while keeping ACoS in check. Our in-depth discussion on Amazon PPC covers how to optimize campaigns at different stages of product growth.

Budgeting for Ads

There's no fixed "fee" for advertising – you might spend ₹5,000 or ₹5,00,000 a month depending on your scale and strategy. A new seller might start with a small daily budget (say ₹500/day) to gather traction. It's important to measure results; for instance, if you spend ₹1000 on ads and it generates ₹5000 in additional sales, your ACoS is 20%. Whether that's good depends on your profit margins. Many brands also invest in display ads for brand awareness, or run lightning deals (which involve promo fees).

To minimize advertising costs, focus on relevant keywords and good targeting. The science of keywords in Google Ads similarly applies to Amazon – choosing the right keywords can prevent wasted spend on irrelevant clicks.

Also, ensure your product listings are optimized (great images, titles, descriptions), because a well-optimized listing converts better, giving you more sales per ad click. In short, ads should be seen as an investment to drive sales; use them smartly so they boost your overall profits, not just Amazon's. For more on advanced Amazon ad strategies, check out our piece on AI-optimized campaigns for Amazon & Flipkart, which explores how machine learning can improve campaign ROI.

Putting It All Together: Example of Amazon Fees

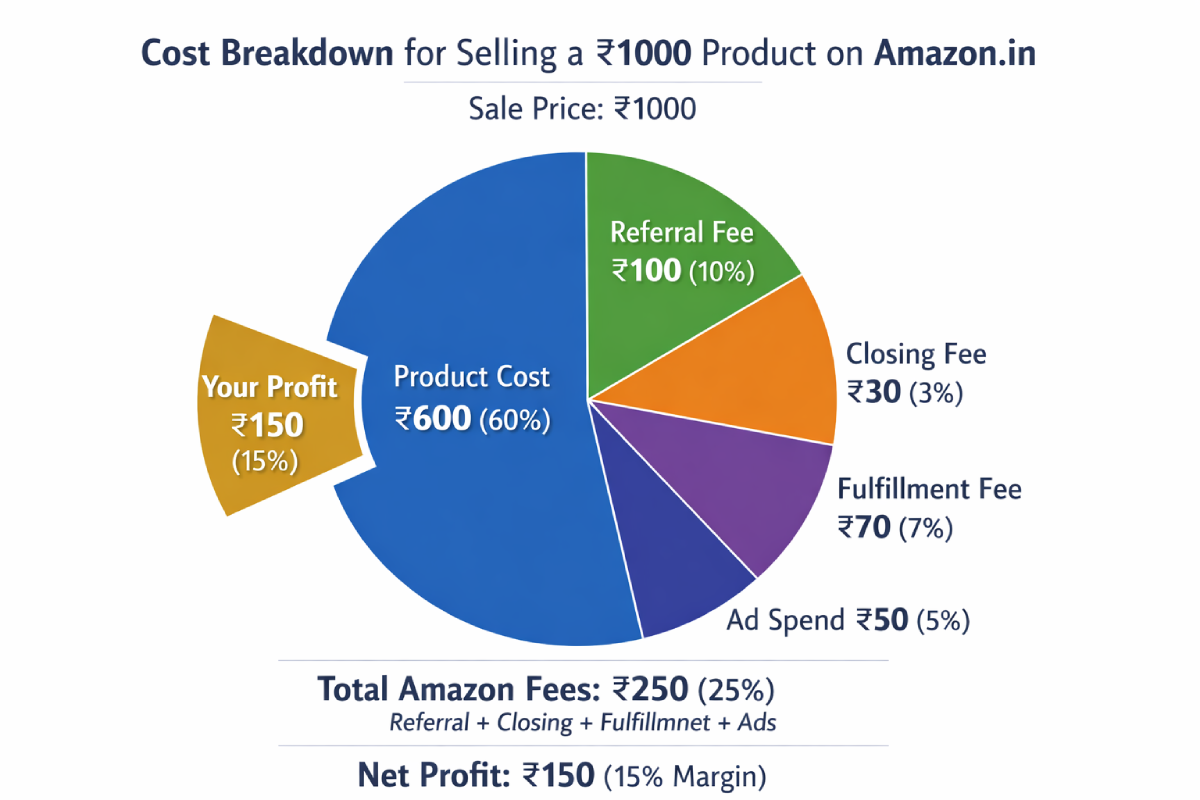

It's helpful to see how all these charges add up in a real scenario. Let's say you sell a product on Amazon.in for ₹1000. Here's a hypothetical breakdown of costs and profit:

Example: You source the item for ₹600. Amazon's referral fee (assuming 10% category) is ₹100. Closing fee for ₹1000 might be ~₹30. Shipping/fulfillment fee is say ₹70 (for packing and delivering a standard package). You also spent about ₹50 on Amazon ads to sell this unit. Amazon's total cut here is ₹250 (25% of sale). After your ₹600 cost, you're left with ₹150 profit (15% margin). If ads were lower or if you self-ship to save ₹20, you could profit more; if fees were higher (e.g. heavier item), profit would shrink. This example shows why tracking all fees is critical – they directly affect your margins.

In many cases, around 1/3 of the selling price can go to Amazon when using FBA and advertising[2]. Top sellers succeed by accounting for these costs upfront and optimizing every component.

Tips to Reduce Amazon Seller Charges

While many Amazon fees are unavoidable, profitable sellers actively optimize around them. The goal isn’t to eliminate fees but to ensure every rupee you pay is justified by returns. Below are proven ways to reduce Amazon seller charges without compromising growth.

Choose the Right Selling Plan

Amazon offers Individual vs Professional selling plans. In India, the Professional plan costs ₹3,000 per month (₹3,540 incl. GST) and removes the per-item fee while unlocking advertising, bulk listings, and advanced reports. Individual sellers pay ₹10 per item sold (plus applicable GST) with no monthly subscription fee.

If you sell more than 40 units/month, the Professional plan is almost always more cost-effective. Otherwise, starting as an Individual seller helps avoid unnecessary fixed costs.

Price Strategically Around Fee Slabs

Amazon referral fees often change at specific price thresholds (for example ₹300, ₹1,000, or ₹5,000 in certain categories). Pricing slightly below a higher slab without hurting perceived value can save meaningful margin.

You can also experiment with smaller pack sizes or bundles to stay within lower fee brackets. Over time, even a 1–2% reduction in referral fees compounds into significant savings.

Optimize Fulfillment & Shipping Costs

Fulfillment fees depend heavily on weight, size, and delivery distance. For many products, Amazon FBA’s negotiated shipping rates are cheaper than self-shipping especially for pan-India deliveries.

However, for bulky or slow-moving items, FBA storage and handling fees can eat into margins. Some sellers use a hybrid model:

-

FBA or Easy Ship for distant orders

-

Self-ship for local or high-margin orders

Also, optimize packaging. Reducing dimensions or weight can drop your product into a lower fee band. If eligible, Amazon’s Small and Light program offers significantly reduced FBA fees for lightweight products.

Improve Sell-Through & Control Inventory

Slow-moving FBA inventory leads to monthly and long-term storage fees. A simple rule: only send inventory that can realistically sell within 2–3 months. Track sell-through rates, remove aging stock before long-term fees apply, and replenish in smaller batches. Strong inventory discipline directly lowers Amazon charges.

Reduce Dependency on Paid Ads with Organic Growth

Every organic sale saves you advertising costs. Investing in Amazon SEO better titles, keyword optimization, strong images, and genuine reviews helps products rank naturally.

Winning badges like Amazon’s Choice or Best Seller can significantly lift organic conversions. If you’re aiming for this, explore ways to earn the Best Seller badge. Better rankings = fewer paid clicks needed to drive sales.

Monitor Advertising ROI Closely

Ad spend is effectively another seller charge if left unchecked. Regularly track ACoS and TACoS, pause low-performing keywords, and add negative keywords to block irrelevant clicks.

High-converting keywords deserve more budget; poor performers don’t. Advanced sellers use TACoS vs ACoS analysis to decide where ads genuinely support growth versus where they just burn margin.

Design Products & Packaging to Reduce Fees

Shipping and fulfillment fees scale with weight and dimensions. Even small changes—lighter materials, compact boxes, foldable designs can push products into cheaper brackets. If your product sits just above a threshold (for example 500 g), redesigning packaging can save several rupees per order, which adds up fast at scale.

Leverage Volume & Economies of Scale

Some Amazon costs (like the Pro subscription or certain fixed operational costs) shrink as a percentage of revenue when sales volume increases. Higher velocity also improves organic ranking, further reducing ad dependency.

That said, volume should never come at the cost of margin. Short-term promotions or deals should always be evaluated against net profitability.

Watch for Promotions, Waivers & Policy Updates

Amazon occasionally offers referral fee waivers, discounted FBA rates, or onboarding benefits for sellers in specific categories. Staying updated through Seller Central announcements or resources like our Amazon e-commerce growth insights can unlock temporary margin wins.

Audit Your Fees Regularly

Amazon fee errors are uncommon but real. Quarterly audits of fee reports can uncover overcharges related to weight, returns, or incorrect classifications. Recovering even small discrepancies improves your bottom line over time.

Reducing Amazon seller charges isn’t about cutting corners it’s about using Amazon’s ecosystem intelligently. Choose the right plan, price with fee logic, optimize fulfillment, and let data guide decisions. In the long run, saving even 3–5% in total costs can be the difference between a break-even business and a scalable, profitable one. For more strategies that improve unit economics, explore our guide on how to increase sales on Amazon.

How GrowthJockey Can Help

Navigating Amazon's fee structure and optimizing ads can be complex. This is where partnering with experts can give you an edge. GrowthJockey positions itself as a full-stack venture builder that not only mentors businesses but also runs performance marketing campaigns to augment a company's growth. We have built systems and AI tools to help sellers dominate on Amazon – from automating campaign optimizations to fine-tuning your product listings for maximum conversion.

In short, we act as growth partners: handling the heavy lifting of Amazon advertising, data analysis, and strategy, so you can focus on product and supply. By using techniques like AI-optimized campaigns and deep data insights, we help reduce wasted ad spend, improve organic rankings, and ultimately boost your ROI on Amazon. As a venture builder, GrowthJockey's goal is to scale ventures in a sustainable way – that means paying close attention to metrics like fees, ACoS, and margins, not just top-line sales. If Amazon's rules or costs feel overwhelming, remember you don't have to do it alone.

Frequently Asked Questions

Q1. How much does Amazon charge its sellers?

Amazon mainly charges a referral fee (commission), usually 8–15% for most categories in India, though it can range from ~2% to 30% depending on the product. Sellers also pay a closing fee per order and shipping or FBA fees based on weight and distance. If you use Amazon Ads, advertising spend is extra. Overall, sellers typically give up around 20–30% of the sale value in total fees

Q2. How much will it cost to start selling on Amazon?

Creating a seller account on Amazon.in is free. You can choose the Individual plan (no monthly fee, per-item charge) or the Professional plan (monthly subscription). Your main upfront costs are inventory, GST registration, packaging, and optional advertising. Most Amazon fees apply only after you start getting orders.

Q3. What is Amazon’s ₹5 charge?

The ₹5 charge is a marketplace fee added to customer orders on Amazon.in, not a seller fee. It is paid by the buyer at checkout and does not reduce the seller’s payout. Some categories are exempt, but for most products the fee applies. Sellers only need to be aware of it from a pricing and customer-experience perspective.